Chinese EV buyers get four more years of tax breaks as US incentives fall flat

Low eligibility bar

Beijing this week unveiled new technical requirements for EVs eligible for tax breaks and the bar has been set low enough that over 90% of electrified passenger vehicles sold in the country will qualify according to the ministry responsible.

From 2024, Chinese buyers would not have to pay tax on a full electric vehicle (BEV) that has a driving range of at least 200km (~124 mi) per charge. Plug-in hybrid cars (PHEV) should have a battery-only range of at least 43km (~27mi) to qualify.

Vehicles that cannot drive at speeds of more than 100km per hour are not eligible under the rules, while EV batteries with energy density below 125Wh/kg also do not qualify. The new regulations also specify that in cold weather, EVs that lose 35% or more range or have less than 120km (~75 mi) of driving distance in these conditions are excluded.

The EV incentive package, worth a total of $72 billion, was first introduced in June and will run until 2028. EVs bought in 2024 and 2025 will be exempted from sales tax up to a maximum of 30,000 yuan ($4,180). The maximum tax exemption falls to 15,000 yuan ($2,090) in 2026 and 2027.

Going for a song

Compared to China, US federal EV tax breaks are more generous – up to $7,500 per vehicle – and combined with various state rebates and cash incentives (Colorado’s adds up to a mouthwatering $13,500), buying an electric vehicle should be in reach for most Americans.

To qualify in the US, the MSRP of electric vehicles must be $80,000 or less for SUVs, vans, and trucks, and for all other EVs must be $55,000 or less. In November, the average price paid in the US for an EV was $52,345 — down more than $12,000 compared to last year, mostly on the back of Tesla’s price cuts for its pre-refresh Model 3.

Unlike the US, under the Chinese rules, the price of a vehicle does not alter the eligibility for tax breaks. No-one says no to a tax break, but average selling prices in China are already some 50% below US MSRPs for comparable models.

The best-selling electrified car in China in 2023 is the BYD Song Plus DM-i plug-in hybrid, with a range of 1,000km, including 150km in fully electric mode, and a price tag of $23,000. Number two, Tesla’s ageing Model Y, now starts at $36,550 following a price hike in November.

US price is not right

While average US selling prices have fallen dramatically the past year, rules published by the US Treasury Dept earlier this month will render the vast majority of EVs for sale in the world’s second largest auto market ineligible for the $7,500 tax break.

Starting from 2024, EVs that contain any battery components manufactured or assembled by a Foreign Entity of Concern (read China) will not be eligible for the tax credit.

The incentive cut-off date for any lithium, nickel, cobalt and graphite or other battery metals produced by, or which make their way through China, is 2025. Rare earths, found in more than 80% of EV motors globally, are already subject to these rules.

Less than a fifty-fifty chance

To what extent incentives at the retail level have boosted China’s EV market is debatable although frenzied buying during previous years in the run-up to subsidy schemes ending or changing suggest it has played some role.

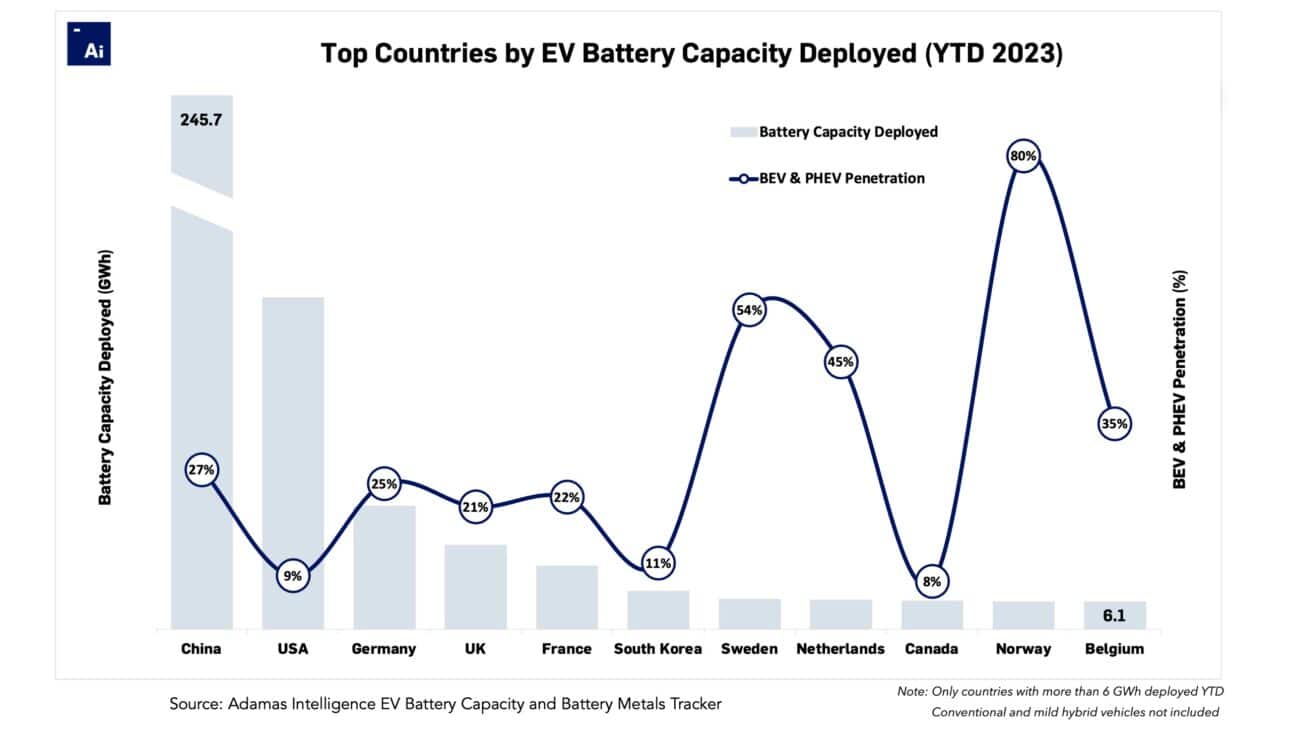

However, the country’s dominance of all aspects of the global mine-to-megawatt supply chain – the key to affordability – likely had a much bigger impact and helps explains the eye-popping reality that from January through September, the total battery capacity of all newly sold BEVs and PHEVs in China was more than three-times the battery power hitting US roads.

BEV and PHEV registrations in China constituted 27% of total passenger car sales in the nation through September, up from 23% last year. In the US, the EV penetration rate is only 9%, an improvement from 7% during the same period in 2022.

That’s a long way away from the US government’s goal of EVs at 50% of overall sales by the start of the next decade. And with the new FEOC rules affecting made-in-China EVs and batteries, that goal looks like it may now disappear over the horizon.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview