Canada’s new EV mandate will shower money on Tesla

Revolving credit

Canada’s new Electric Vehicle Availability Standard (EVAS) mandates that 20% of new passenger vehicle sales must be full electric (BEV) or plug-in hybrid electric vehicles (PHEV) by 2026, 60% by 2030 and 100% by 2035.

Environment and Climate Change Canada’s new rules are similar to regulations in California (first introduced in 1990) and Europe, and include a credit trading system which automakers can use to avoid paying penalties should they miss targets.

Conventional or mild hybrids do not count towards automakers’ targets and PHEVs will receive partial credits if the electric-only range is below 80km. In addition, how much PHEVs can count towards compliance obligations is also capped at 45% in 2026, 30% in 2027, and 20% in 2028 and later.

There are also so-called Early Action Credits available before 2026 if an automaker’s fleet is at least 8% EV this year and 13% in 2025. Credits can also be earned for investing in new fast-charging stations – one credit for every $20,000 spent.

Together, early action and charging credits can contribute to no more than 10% of an automaker’s obligations in any given year and will be phased out by 2028.

Assault on battery

The Canadian government’s subsidies for EV purchases of up to C$5,000 ($3,750, equal to half that offered in the US) are not altered by the new rules and can be combined with a provincial rebate program, such as that in British Columbia (up to C$4,000), and in Quebec (maximum C$7,000).

On a sales basis, Canada lags global growth rates with just 27% more EVs (excluding conventional hybrids) finding owners in the nation from January through October last year. Worldwide, registrations are up 33% over the same period.

Close to 119,000 Canadians got behind the wheel of a new BEV or PHEV last year affording the country a 1.1% global market share.

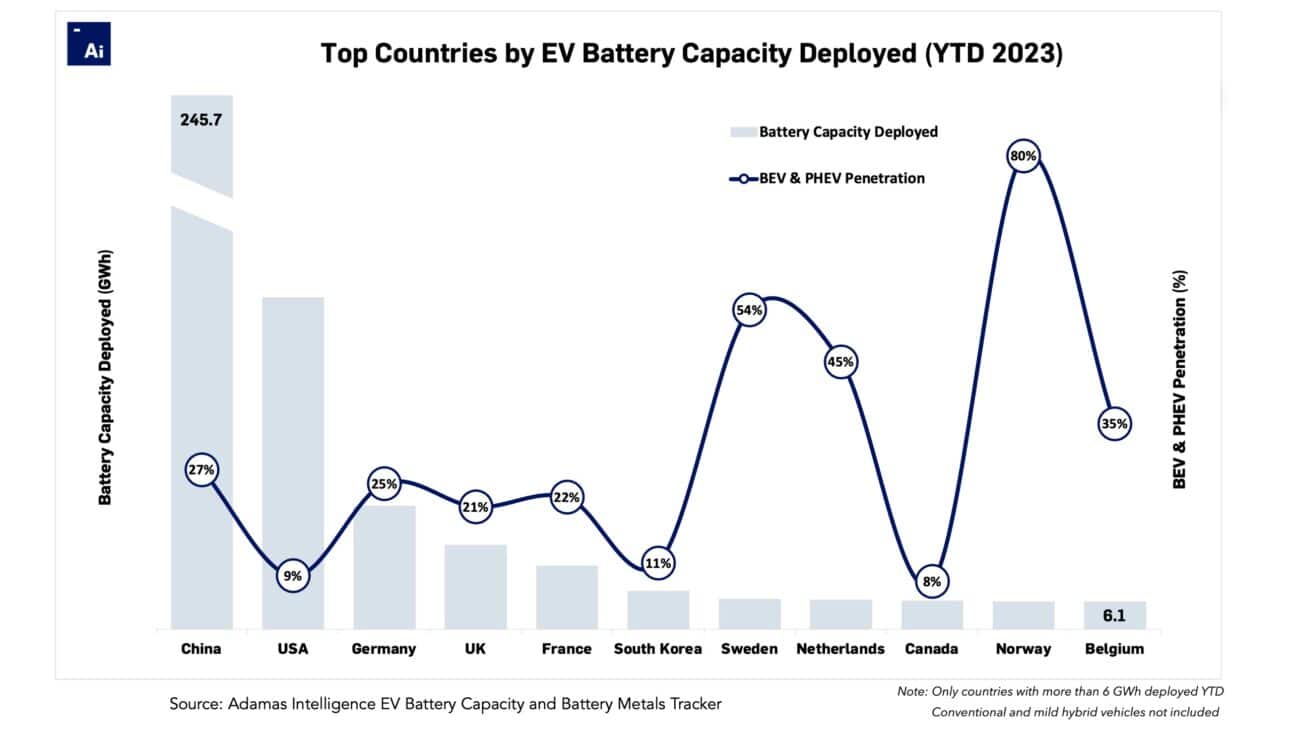

Based on the combined battery capacity (GWh) of BEVs and PHEVs sold through the first 10 months of 2023 – a better measure of the size of the market than unit sales alone – Canada is the world’s ninth-largest electric car market, according to Adamas Intelligence data.

But at just 8% EV penetration (up from 7% last year), the country is ranked last when comparing EV adoption rates among top countries.

Phew! It’s a PHEV

The EV edict acknowledges the misgivings residents of the north have about performance in the cold and lack of charging infrastructure in regions where vast distances must regularly be covered.

In response, Canada says PHEVs “can be a good fit” for concerned drivers. The advice from bureaucrats to northerners is certainly sound. There isn’t a BEV on sale in Canada currently that could make the journey from Whitehorse to Dawson City in winter on a single charge. Not one under C$100,000 anyway.

The EVAS mandate points to the success of Norway (a country which also gets cold and is also home to isolated communities) in cajoling 80% of car buyers to opt for electric last year.

No mention of the average $27,000 – that’s $36,000 Canadian – in tax breaks per EV Norwegians receive, however.

The surging popularity of PHEVs was one of the biggest global trends in the electrified car market in 2023. Globally, registrations of the range anxiety soothers were up a whopping 49% year-to-date through October compared to 31% for BEVs.

Nearly 22% of Canada’s EV sales over the same period were plug-ins, in line with the global average, but Canada’s PHEV sales growth rate is falling behind the rest of the world’s. Only 10% more PHEVs found buyers in Canada through October 2023 than the same period the year prior.

Are we there yet?

When applying the EVAS system of credits to PHEVs, the 2026 deadline – or the 2035 one for that matter – looms large.

Globally, not only are many more PHEV units leaving dealership lots than years prior, but they are increasingly coming equipped with bigger and bigger batteries. The sales-weighted average PHEV sold in through the first ten months of 2023 had a 20% bigger battery than the same period the year prior, topping 20kWh.

However, in Canada the average over the same period was under 15 kWh, which explains why none of the top 10 bestselling PHEVs in Canada can drive 80km on an electric charge alone and thereby score that elusive one credit.

From the Pacific Northwest to the Maritimes, the most popular plug-in in Canada, the Ford Escape PHEV, ekes out just shy of 60km for 0.75 credits.

Canada’s number two plug-in, the Jeep Wrangler 4xe, has a maximum electric range of just 34km, which would earn Stellantis exactly 0 credits, as would its bigger brother the Grand Cherokee. The third-placed Hyundai Tucson PHEV can contribute a slim 0.15 credits to the Korean manufacturer’s score in 2026, but zilch thereafter.

The Chrysler Pacifica, which can do a little over 50km on a charge, will be eligible for a full credit in 2026 and 2027 because it can carry more than seven people.

That said – Chrysler’s only electrified vehicle for sale today is the Pacifica, so the 45% cap on PHEV contributions mentioned earlier would bring the net value of the minivan down to just 0.45 in 2026 should upcoming Chrysler EV models arrive late.

The Tesla Availability Standard

In short, what is supposed to be a “good fit” for Canadians is not such a good fit for automakers trying to avoid EVAS fines.

How much quicker Canada will catch up to the likes of Norway – personally thanked by Elon Musk for “their incredible support” in a tweet a year ago – under the new mandate is an open question.

Given the trouble legacy automakers have had to bring attractive and affordable EVs to market, that EVAS will give car company CCOs and CFOs heartburn chasing credits for many years to come is more of a sure thing.

Or they could just call Tesla now.

Since 2015, Tesla has earned just under $12 billion by selling carbon credits to carmakers in Europe and elsewhere. These payments have grown steadily and hit a record $554 million in the third quarter of 2023.

Canada can now be added to the list of countries contributing to Tesla’s regulatory windfall.

The electric car pioneer sold one out of every two BEVs in Canada in October 2023, the latest month with complete registration data.

Through the first ten months of last year, the Texas-based company was responsible for 36% of all new power-hours rolled onto roads in the wintry country, and that was before the arrival of the refreshed Model 3 and Cybertruck, which have since followed.

“This regulation will help ensure Canadians have access to the latest affordable and technologically advanced vehicles that are coming to the market,” Environment and Climate Change Canada proclaimed.

The average price of an EV in Canada is C$73,000 although the Model 3 can be picked up for C$52,000 before incentives. Add full self-driving capability and it’s still cheaper than the run-of-the-mill Canadian EV.

As such, it seems like affordable and technologically advanced electric cars are already in Canada. And Ottawa’s new mandate is simply giving credit where credit is due.

RELATED: Chinese EV buyers get 4 more years of tax breaks as US incentives fall flat

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview