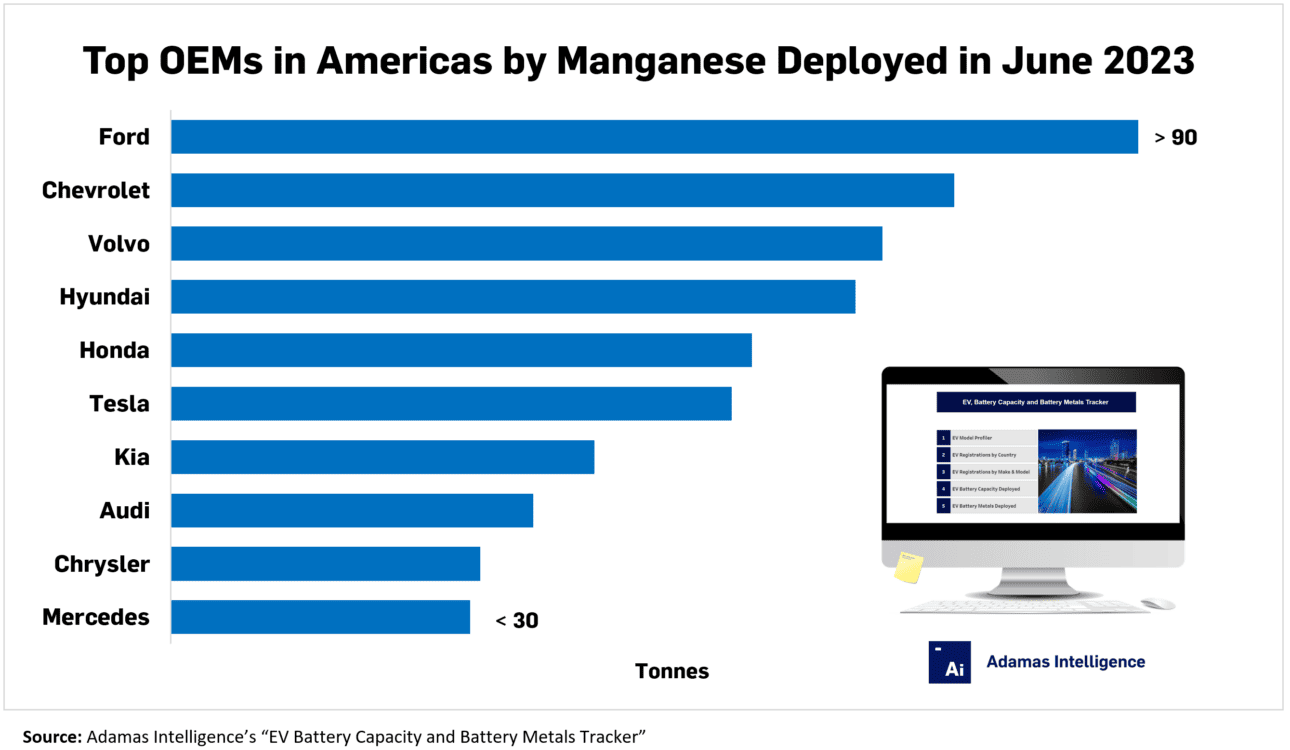

Top 5 OEMs in Americas by Manganese Deployed in June 2023

Ford tops the list in the Americas followed at a distance by Chevrolet and Volvo

With backers including Tesla and Volkswagen, manganese-rich batteries could one day challenge lithium iron phosphate (“LFP”) at the lower end of the EV market, but for now, virtually all battery manganese deployed on roads worldwide comes in the form of nickel-cobalt-manganese (“NCM”) cathode chemistries, data from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows.

Ford tops the list in the Americas for manganese deployed in newly sold electric cars, including hybrids and plug-in hybrids, in June this year. The U.S. carmaker was responsible for 13% of the manganese deployed during June 2023 at just over 90 tonnes, up 57% from the same month last year, boosted by the popularity of its Mustang Mach-E.

Second in term of manganese tonnage in the batteries of its vehicles which found buyers during the month was Chevrolet. Chevrolet is closing orders for its Bolt EV and EUV at the end of the month and the production run for the popular entry-level vehicle is likely to end some time in December.

GM initially wanted to retire the nameplate, but after aficionados of the city runaround complained, the Detroit-based carmaker changed plans and will now introduce a second-generation Bolt, but so far, no release date has been set.

Volvo takes the number three spot, boosted by sales of its C40 Recharge, a Tesla Model Y rival, and the Polestar 2, which went on sale in the U.S. a year ago and is assembled in China. The Polestar brand was spun out of the Swedish carmaker in 2017 to further the electric ambitions of the company which is owned by China’s Geely. Geely bought Volvo from Ford in 2010.

Hyundai pushed its way into the number 4 slot with the help of its Ioniq 5. The Ioniq 5, which sports a design harking back to the iconic Lancia Delta Integrale of the late 80s, was the 5th best-selling full electric car in the U.S. in June, despite frustratingly long waiting lists of eager buyers.

Honda, which has yet to take to the full-electric stage, rounds out the top five. The Japanese carmaker must rely on strong sales of its CRV and Accord hybrids to make a dent in the standings in the Americas although the upcoming launch in 2024 of the Prologue BEV may usher in a new chapter for the company.

Note: In order to produce the most accurate and granular data, battery capacity and metal deployed numbers in the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain; only end-user registered vehicles are considered.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview