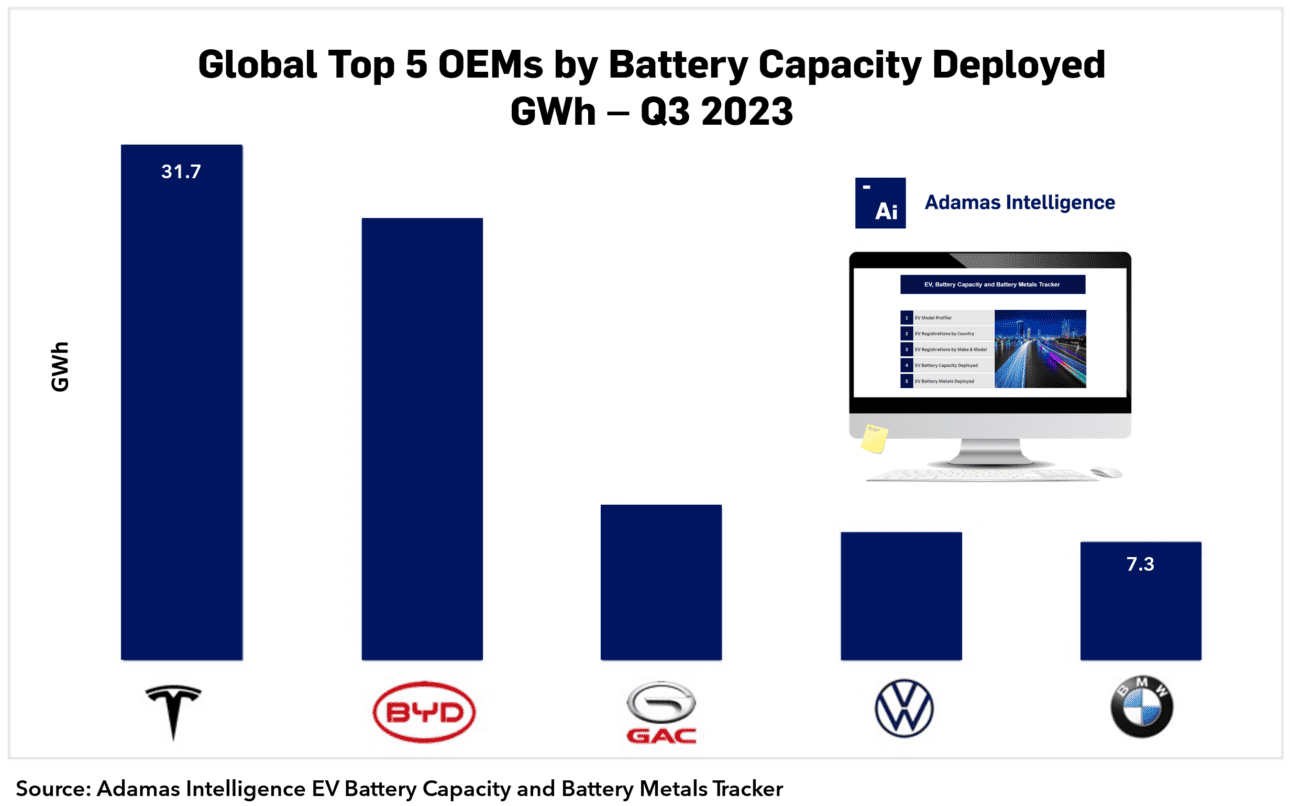

Top 5 OEMs by EV battery capacity deployed in Q3 2023

Tesla led the pack in Q3 2023 but BYD is closing in

In Q3 2023, a record 182.6 GWh were deployed onto roads globally in the batteries of all newly sold passenger xEVs (BEVs, PHEVs and HEVs) combined, up 11% quarter-over-quarter and 39% over the same quarter the year prior, according to data from the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker.

Tesla led the pack globally with 31.7 GWh deployed onto roads in the three months through September, down 7% quarter-over-quarter but up 25% over the same quarter the year prior.

Closing in on Tesla in second spot was BYD with 27.2 GWh deployed globally, up 15% quarter-over-quarter and 42% over the same quarter the year prior.

In a distant third was China’s GAC, which deployed 9.5 GWh onto roads globally in Q3 2023, up 14% quarter-over-quarter and 74% over the same quarter the year prior.

The highest ranked Europe-based OEM, Volkswagen, came in at number four with 7.9 GWh deployed in Q3 2023, an increase of 6% quarter-over-quarter and 11% over Q3 2022.

This figure includes Volkswagen-branded passenger EVs sold in China made with domestic joint venture partners FAW and SAIC. Excluding the German company’s Chinese EV operations, Volkswagen is the 7th largest electrified carmaker by battery capacity deployed during Q3 2023 after recording a sequential decline of nearly 5% compared to the second quarter.

In fifth place, BMW deployed 7.3 GWh onto road globally in Q3 2023, up 5% quarter-over-quarter and 96% over the same quarter the year prior.

Adamas take:

While sequential growth rates in terms of EV battery capacity deployed remain robust overall, some OEMs have lost momentum, most notably Tesla.

The decline in battery power hours new Tesla owners took to the streets during the third quarter was greatest in Asia, where capacity deployed declined by 11.5%. Tesla was also in retreat in the Americas (–5.6%) and in Europe (–9.6%) during the quarter.

In Asia, Tesla is facing increasingly stiff competition from the likes of BYD, GAC and Li Auto fueling a slowdown there. In North America and Europe, at least some of the Q3 2023 lull for Tesla can be attributed to buyers waiting for delivery of the refreshed Model 3 Highland, which started in October.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview