Top 5 EV cell suppliers in the Americas

Tesla tails top 5

Through the first 11 months of last year, 104.4 GWh of battery capacity was rolled onto roads in the Americas in all newly sold passenger EVs (BEVs, PHEVs and HEVs) combined, up 51% over the same period in 2022.

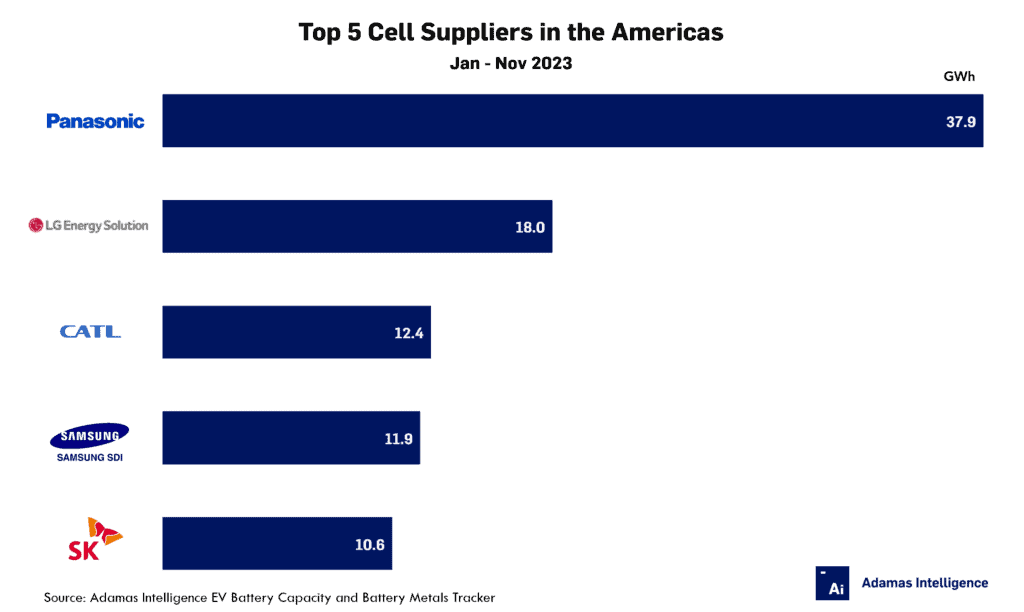

From January through November of last year, the top cell supplier in the Americas was Panasonic, which deployed 37.9 GWh in the region. In a relationship dating all the way back to 2009, 93% of Panasonic’s output last year was fitted to Tesla’s EV models, with the bestselling Model Y alone driving 60% of the Japanese company’s cell sales in the region.

In a distant second place, LG Energy Solution steered 18.0 GWh onto roads in the Americas over the same period. The top models powered by LGES cells are the Ford Mustang Mach-E and the Chevrolet Bolt EUV, with 20% and 17%, respectively, of the Korean company’s sales in the region going into the crossover and compact hatch specifically.

In third place, CATL drove 12.4 GWh onto roads in the Americas from January through November last year. Specifically, 54% of the Chinese company’s cell sales in the region last year were driven by the Tesla Model 3.

Following closely behind in fourth and fifth were Samsung SDI (11.9 GWh deployed) and SK On (10.6 GWh deployed). Samsung SDI is a key supplier to Rivian, domestic manufacturer of the popular R1S large SUV and the R1T truck, while SK On’s cells are used in the Ford F-150 Lightning.

And just outside the top five cell suppliers in the Americas is Tesla. The company’s own 4680 cells power the performance version of the Model Y that it’s been manufacturing in Texas since 2022. In a testament to the Model Y’s dominance in the region, the soda-can-sized 4680s that it sports made up over 6% of all GWh deployed onto roads in the Americas last year through the end of November.

Adamas take:

While much ink has been spilt about a slowdown in the EV market in the US and surrounding region, November saw a record 10.7 GWh of new battery capacity deployed onto roads in the Americas, up 52% year-over-year and outpacing growth elsewhere.

The Asia Pacific region saw combined battery capacity of 43.7 GWh deployed in November, also an all time high and 39% higher than November 2022.

European battery capacity deployment of 14.4 GWh was the outlier with growth of just 7% year-over-year.

When the data for December – historically the best month of the year by a large margin – is analyzed and aggregated, expect talk of a general pullback from vehicle electrification to prove overblown.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview