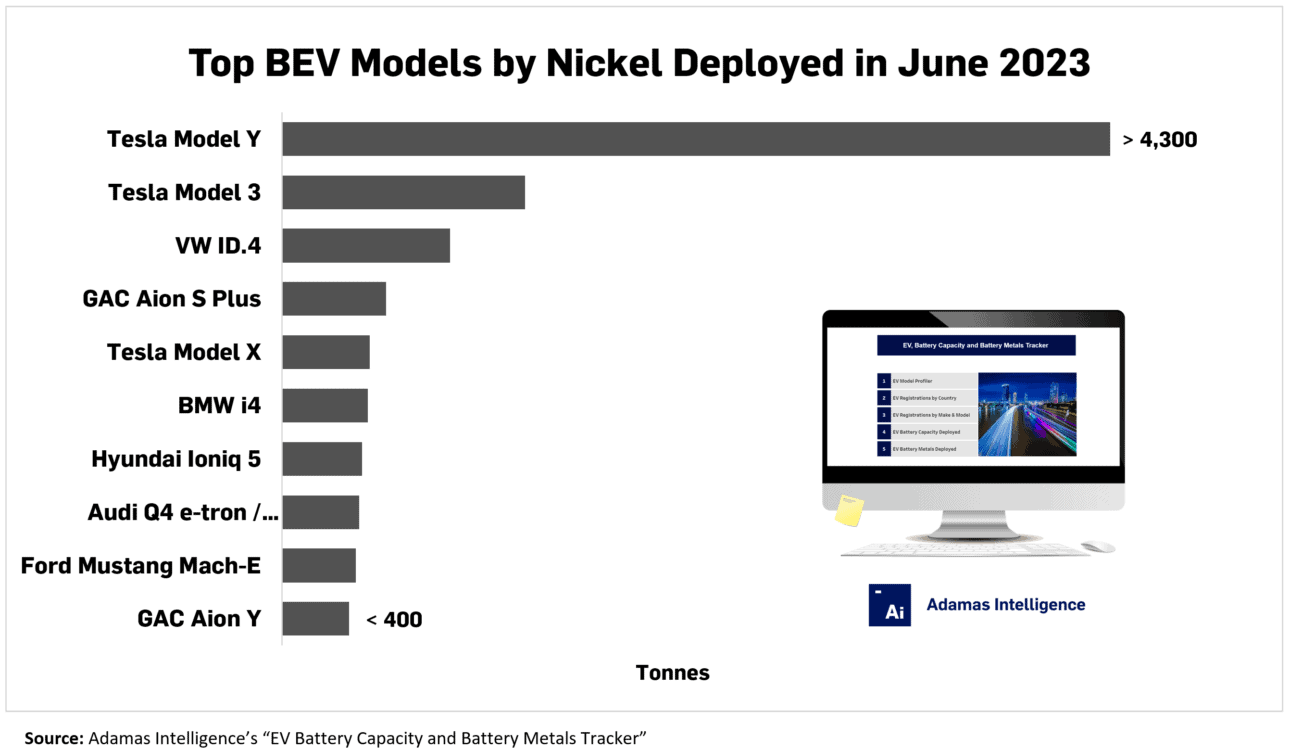

Top 3 BEVs by Nickel Deployed in June 2023

Market for devil’s copper coming under immense pressure

Nickel bulls may not be having as hard a time as investors trying to catch the falling knife that is the cobalt price, but the market for the devil’s copper is coming under immense pressure as Indonesia – already responsible for half global nickel production – continues to ramp up output.

Last week the Asian country’s president, Joko Widodo, made a bid to negotiate a free trade deal with the U.S. to get in on the $430 billion U.S. Inflation Reduction Act. Under the IRA, a certain percentage of battery metals going into EVs must be sourced locally or from countries with which the U.S. has free trade accords in place.

The China-Indonesia nickel pig iron trade is the backbone of the global industry. Even amidst booming demand from EVs, most of the nickel mined around the world still ends up as stainless steel.

But considering China’s faltering real estate sector and tepid manufacturing industry, virtually all the additional demand growth for nickel today is from lithium-ion batteries, and specifically nickel-cobalt-manganese (“NCM”) cathodes used widely in passenger electric vehicles. Should Indonesia qualify as a supplier of metals to the U.S. under the IRA, the global scramble for battery-grade nickel will only intensify.

Just 10 models responsible for 42% of all nickel deployed onto roads

In June 2023, the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows that over 22,500 tonnes of nickel were deployed onto roads globally in the batteries of newly sold EVs, 21% more than the month prior and 41% more than the same month the year prior.

Just 10 EV models were responsible for 42% of all battery nickel deployed onto roads globally in June, up from 38% the same month the year prior, after their collective nickel consumption jumped 56% year-over-year.

Tesla’s Model Y topped the charts by nickel deployed in June 2023 with an eye-catching 19% share among the top models followed by the Model 3 with 6% of the market and Volkswagen’s ID.4 at 4% when including made-in-China versions.

By nickel deployment, Chinese models are underrepresented among the top 10 due to the popularity of nickel-free lithium iron phosphate (“LFP”) based models in the country – half of newly sold EVs there sported LFP battery packs in June. Only the GAC Aion S Plus and the Aion Y made the top 10, Adamas data shows.

Note: In order to produce the most accurate and granular data, battery capacity and metal deployed numbers in the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain; only end-user registered vehicles are considered.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview