Top 10 fastest growing EV makes

Spinoffs, JVs and startups

Calendar 2023 was a record-breaking year for the global electric vehicle industry with 691.4 GWh added to the passenger electric car parc, an expansion of just over 200 GWh or 41% compared to 2022.

There are almost 200 brands currently offering passenger electric vehicles around the world. Most of them are Chinese and many with names few would have heard of outside their home market: Trumpchi, Cao Cao, Lingbox, Jetour, Aeolus and Sehol to name a few.

The proliferation of EV brands is also indicative of Chinese automakers’ fondness for creating spin-off brands to cater to every possible segment and demographic, with Geely, Chery, Dongfeng and BYD (which last year launched its Yangwang and Fangchengbao brands) particularly guilty in this regard.

Joint ventures are also the birthplace of many new brands in China with lumbering state-owned firms keen to tie up with more nimble technology companies to add some cutting-edge to their offerings, with Alibaba and SAIC’s IM Motors a recent example.

Chinese OEMs do not appear to be sentimental about brands either. Sehol, which is scarcely five years old, is being retired in favor of Yiwei for instance after the owners of the brand, Volkswagen and JAC Motors, decided to reorganize their joint venture.

But the ranks are beginning to thin somewhat with at least four high profile bankruptcies just in the last quarter of 2023 alone including WM Motor and its Weltmeister brand, which managed to blow through $5.3 billion in funding in little over five years.

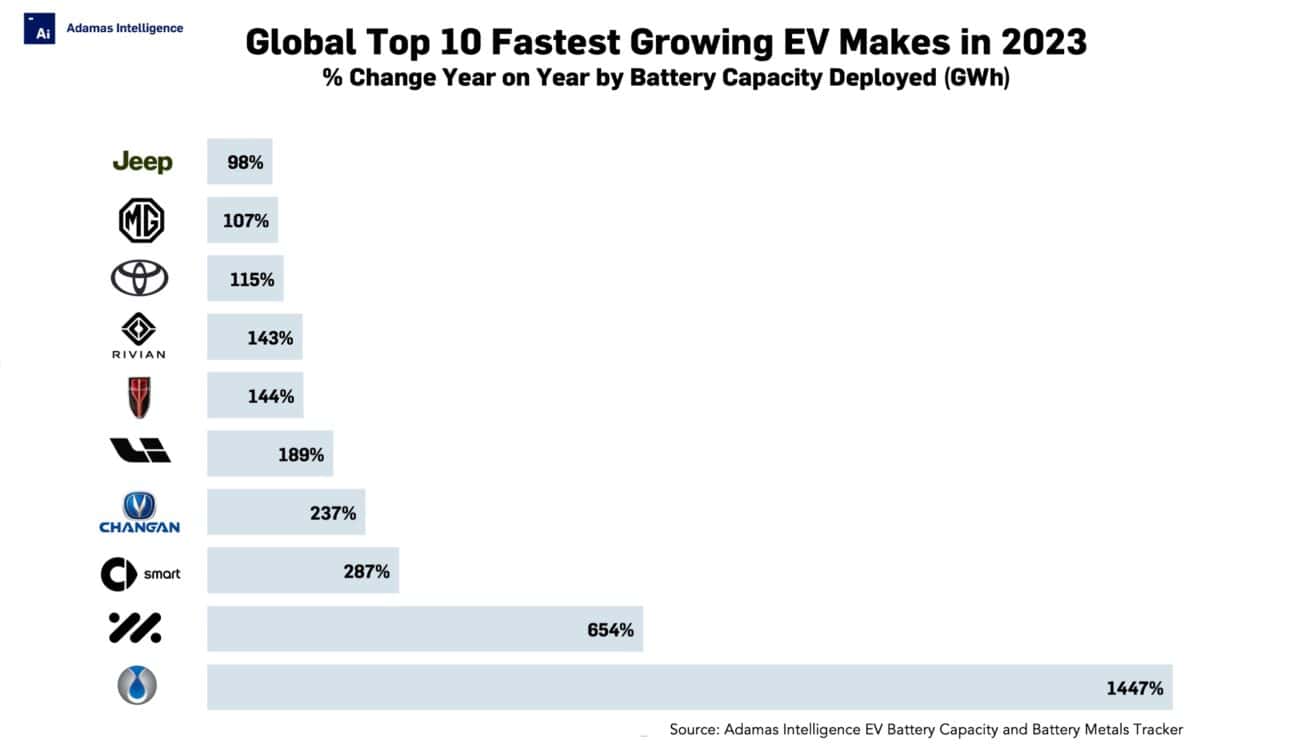

Adamas Intelligence compiled a ranking of the fastest growing brands in 2023 based on battery capacity deployed compared to the year before.

The cut-off to be included in the ranking was deploying at least 3.0 GWh of combined battery capacity in newly-sold passenger vehicles worldwide last year. Through that lens, 39 names qualified.

Merc makes a mark

The fastest growing marque globally last year was Denza, which steered nearly 16 times more battery power onto roads last year than in 2022.

The Denza nameplate was created in 2010 as a joint venture between BYD and Mercedes-Benz (which has since reduced its stake to 10%) and was the Chinese auto and battery maker’s first entry into a more upmarket segment.

The plug-in version of the Denza D9 minivan, which deserves a prize for the size of its grille alone, was responsible for more than 70% of the 5.0 GWh of pack power Denza put in the hands of new owners in 2023.

In second place was the aforementioned IM Motors, which stands for Intelligent Mobility (Chinese Zhiji Motors). The three-year old marque increased its GWh deployment more than 7-fold last year to 3.6 GWh.

SAIC, which owns 54% of IM, has positioned the spinoff in the luxury segment and according to the Shanghai-based company talks are ongoing with Volkswagen’s Audi to purchase the IM platform.

Another Mercedes Benz creation, Smart, slots in at no 3 after expanding battery capacity deployment by 287% last year to 3.8 GWh, most of which ended up in its Smart #1 crossover.

Smart went all electric after its German owner entered into a joint venture with Geely in 2019 but its subcompact urban runabouts are no longer for sale in North America.

In fourth place, Changan’s Deep Blue brand was only unveiled in April 2022 but buyers of the brand in 2023 collectively commandeered a respectable 4.6 GWh of maximum charge, 237% more than in its launch year.

Like Denza, Deep Blue’s most popular model in 2023 was a plug-in hybrid, the SL03 liftback sedan equipped with a range extender.

Li Auto, a PHEV specialist, occupied fifth place after adding 189% more power hours to its fleet last year for a total of 16.3 GWh deployed during the year.

Li Auto this month launched its first all-electric vehicle, the aptly name MEGA, a gargantuan MPV which the manufacturer refers to as a “highway bullet train”.

Doubling up

Number six Hongqi, part of the FAW Group, stands out among the fastest electrifiers in that the marque’s history dates back to 1958 and is considered the oldest passenger car brand in China.

Now an upmarket marque, Hongqi buyers hit the road with a fresh 5.4 GWh in 2023, up 144% year-over-year.

The top US entry, Rivian, made a welcome entrance at no 7 with a combined 6.7 GWh of battery power unleashed last year representing a 143% clip compared to 2022.

Toyota edged out MG, the last Chinese make in the ranking, for eighth place last year after the Japanese company raised the combined battery power of EVs sold to 10.7 GWh, up 115% compared to 2022.

MG, which traces its history back to Oxford, UK in 1924, was transformed into a budget category EV make after Nanjing Auto acquired the firm out of bankruptcy in 2005.

Now owned by SAIC, new MG drivers steered 9.6 GWh onto roads in 2023, 107% more than the year before.

Lastly, at 3.1 GWh in 2023, Jeep cannot officially claim to have doubled its power hour deployment last year like the top 9 but at 98% growth, the marque came pretty close.

Like others in the ranking, the US off-road icon continues to ride the wave of new PHEV buyers with its Grand Cherokee 4xe, Compass 4xe, Renegade 4xe and Jeep Wrangler 4xe, the latter of which was the top selling PHEV in the US two years running.

*Note: To produce the most accurate and granular results, Adamas Intelligence analysis is based on end-user vehicle registrations and retail sales, not extrapolations of production data, wholesale car markets, sales to dealerships or preliminary sales projections.

RELATED: Ranks of the 10 GWh club grows to sixteen

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview