Tesla’s plan for India plant spotlights country’s nascent EV market

India-made Model 2?

Elon Musk told India’s prime minister Narendra Modi during a state visit to the US in June last year that Tesla would be in India “as soon as humanly possible”.

Turns out before the end of April is what is humanly possible. According to a report by the FT last week, Tesla is sending a team to scout locations for a $2 billion to $3 billion EV plant in the world’s most populous nation.

The assembly plant could have a nameplate capacity of 500,000 units a year according to the report and is a candidate for the manufacture of Tesla’s long touted $25,000 mass market vehicle, often labelled the Model 2. Musk has subsequently denied reports that the Model 2 project is on ice and also teased the company’s robotaxi, set to launch in August.

Tesla is also said to be considering co-locating a battery factory at the chosen site, and one of the sources quoted said Tesla’s focus would be on a location near a port to export vehicles rather than selling into the domestic Indian market, which remains largely undeveloped.

While its potential is undoubtedly vast, just over 170,000 electrified passenger vehicles (including hybrids, excluding two- and three-wheelers) were sold in India last year making it the world’s 14th largest EV market (behind Sweden).

The two most popular models in India last year were both conventional hybrids – namely, Toyota’s Urban Cruiser Hyryder and local automaker Maruti’s XL6.

Strip out strong hybrids, which usually have an electric-only range of less than 10km if any at all, and India falls to 17th place with fewer new EV registrations than Thailand in 2023. For context, sales in the latter surged by 355% last year versus growth of 68% on the subcontinent.

Capacity for growth

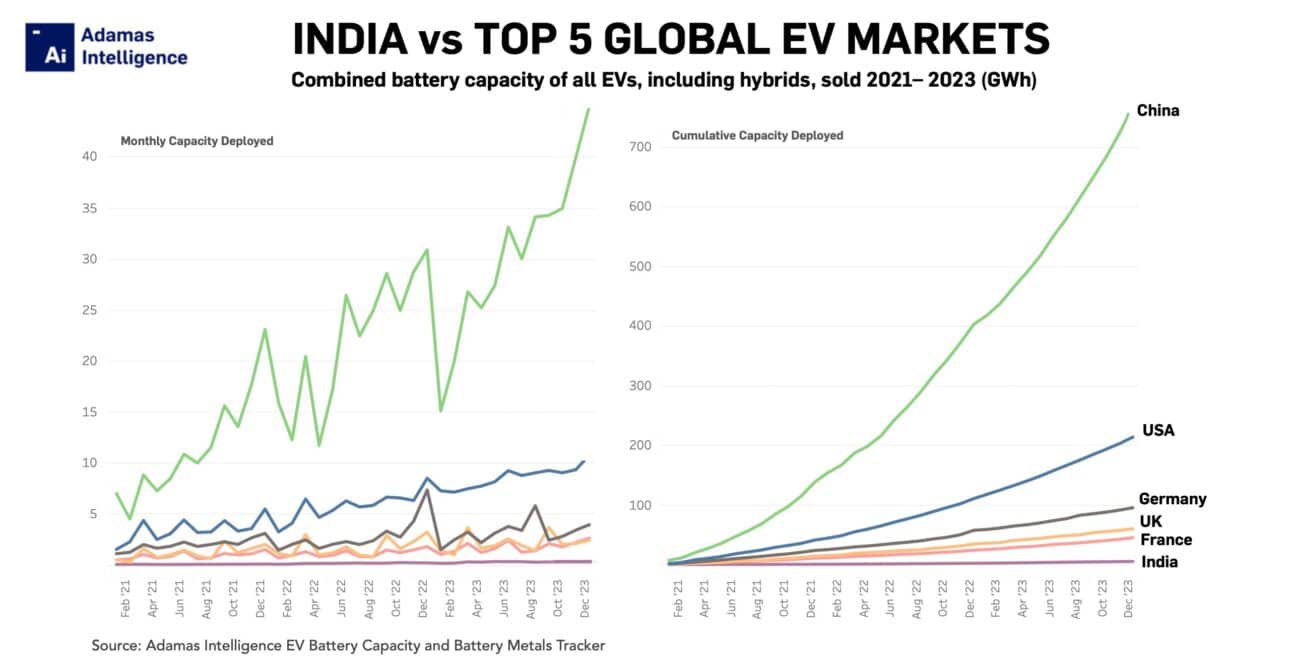

When considering the total combined battery capacity (GWh) of all EVs sold last year, which creates a clearer picture of the rate at which a country is electrifying its vehicle fleet, the infancy of India’s EV market is even more pronounced.

New EVs rolled onto Indian roads in 2023 had a combined battery capacity of just 3.0 GWh, a 75% increase over 2022, Adamas Intelligence data shows. That’s fewer GWh deployed than Israel for the year and places the country outside the top 20.

Compare that figure to the world’s number one EV market, China, where new drivers steered 365.5 GWh onto roads last year, or the US, where fresh power-hours for the calendar year totaled 103.0 GWh.

From a low base, the Indian market continues to grow by leaps and bounds into 2024 with Indian EV buyers steering 104% more GWh onto roads in January than the same month the year prior.

Impressive growth but not nearly enough to close the gap with China or its regional rivals. Despite its size, the Chinese market also doubled in January 2024 compared to the year prior, while regional up-and-comers Thailand, Taiwan, Vietnam and Indonesia grew by 313%, 194%, 522% and 269%, respectively, all outpacing India.

RELATED: Another blow to Tesla’s European expansion

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview