Renault will have to amp up electric car unit for IPO

Proposed listing comes at difficult time for EV stocks

Renault is moving ahead with a spring 2024 public listing for its electric car unit Ampere, CEO Luca de Meo told reporters last month.

De Meo said the spin-off from Renault is being set up to become Europe’s top EV producer “by making cheaper cars than its rivals to attract more consumers than just the early EV adopters.”

Ampere aims to sell 300,000 EVs by 2025 and around 1 million by 2031. The new company plans to launch seven new models by the start of the next decade, including a small car for €20,000, and wants to put EV car prices on par with internal combustion engine-powered ones by 2027 or 2028.

The 124-year old French automaker has put a market value of between €8 billion to €10 billion on Ampere (Renault is currently worth €9.4 billion in Paris), but the listing comes at a tough time for the sector.

Volvo’s all-electric spin-off Polestar is down 74% over the past year, putting a value of $4.5 billion on the stock, while US startup Rivian has lost 40% over the same period, pushing its market worth down to $16.4 billion.

Chinese upmarket all-electric brand Nio’s shares, which were first listed in the US five years ago, are trading down 29% compared to this time last year and are now valued at $12.8 billion. Zeekr, another luxury Chinese EV company, earlier this month filed paperwork for an IPO in New York with hopes of raising $1 billion.

Ampere not plugged in

Combined, Renault and Dacia, which was acquired in 1999 from the Romanian government, have captured 24% of the French EV market through the first three quarters of the year.

The electrified car market in France deployed a total of 4.6 GWh onto roads in Q3 of this year, down 10% from the quarter prior. However, year-over-year, the market has expanded 53% – the fastest growing among the top five EV markets globally.

Despite the French affinity for Renault and Dacia, in Europe more broadly, their combined share of the EV unit market was 9% in Q3 2023, placing the company in second spot, snuggly sandwiched between Toyota and Tesla.

Globally, with low volumes sold outside the continent, including from its joint venture with Dongfeng in China, a would-be Ampere makes up just around 2% of the EV market today.

The Boulogne-Billancourt headquartered company has also not been able to capitalize on a surge in demand for plug-in hybrids (PHEVs) this year, particularly in China.

Through the first nine months of 2023, global PHEV registrations are up 50% over the same period the year prior versus 33% growth for the total EV market over the same period.

This accelerated growth has earned PHEVs 21% of the global EV market year-to-date, up from 19% through the first nine months of last year. In contrast, PHEV buyers only made up some 3% of Renault’s customers so far this year.

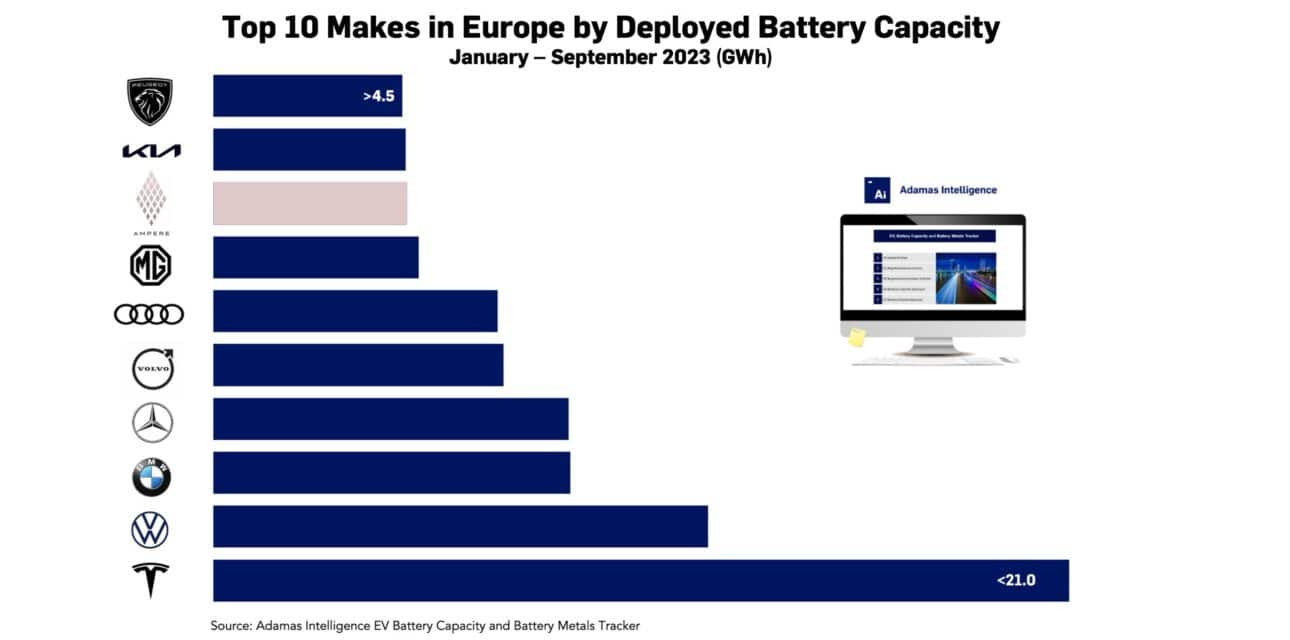

In terms of battery power deployed (a better reflection of market potential and battery metal demand than unit sales alone), the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows that newly sold EVs from the Renault stable unleashed 4.7 GWh onto global highways and byways during the first nine months of 2023.

That represents barely 9% growth compared to the same period last year versus a 50% increase in GWh deployed across all of Europe over the same period.

By this measure, neither Renault nor Dacia alone crack the top 10 marques in Europe when it comes to new EV battery power deployed on the continent’s roads this year. Together, as Ampere, the two brands make it to number 8.

Globally, Renault and Dacia brands have managed to capture just 1% of the global market by power hours hitting roads this year, and a mere 4% in Europe, a reflection of the fact that nearly 60% of the company’s sales this year to-date have been conventional hybrids, which have inherently small batteries.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview