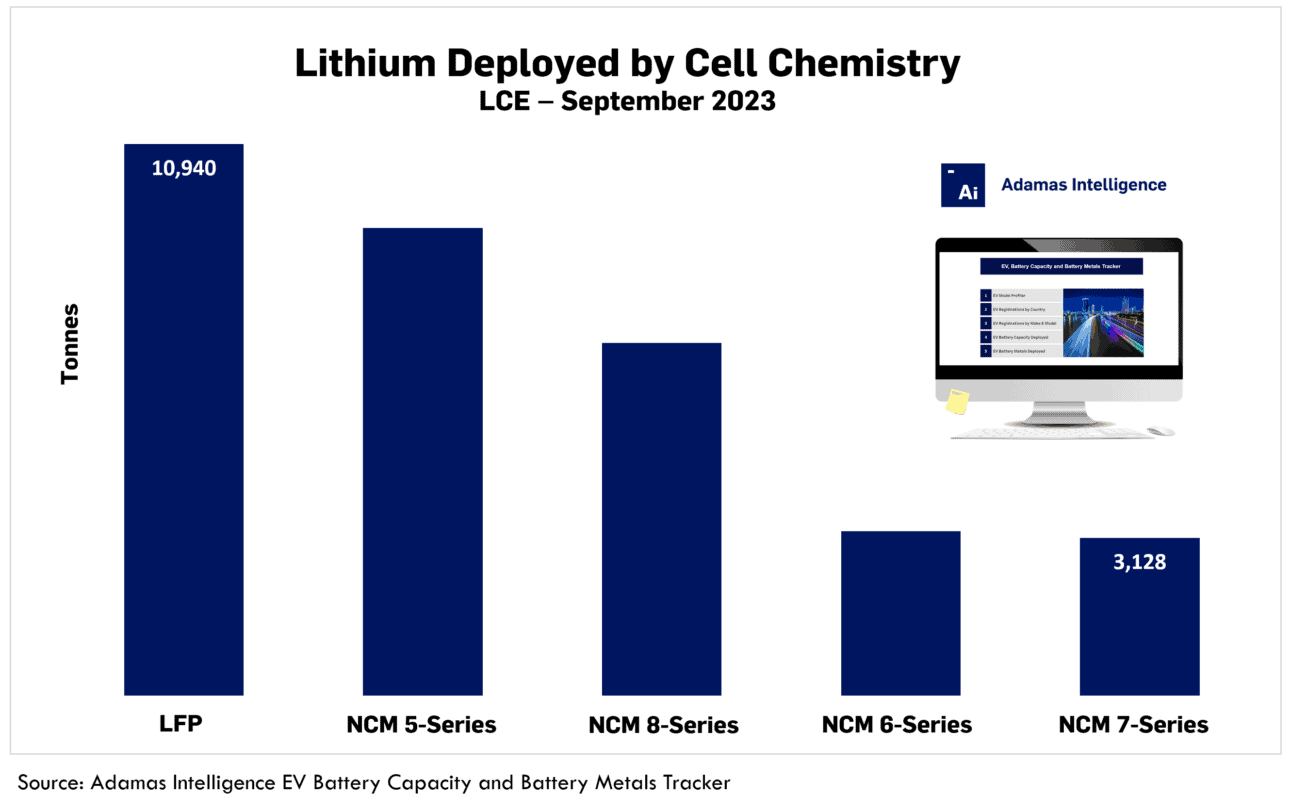

Global lithium demand by cell chemistry in September 2023

Lithium demand growth tracking EV unit sales

In September 2023, a total of 38,067 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally in the batteries of all newly sold passenger xEVs (BEVs, PHEVs and HEVs) combined, up 23% (or 7,227 tonnes) from the same month last year.

This growth was driven by a 24% increase in passenger xEV unit sales over the same period. Year-over-year, average xEV pack capacity went virtually unchanged at 35.7 kWh in September 2023, as did the global market share of LFP (32% by GWh deployed).

Nevertheless, LFP led the pack in September, driving 10,940 tonnes of LCE onto roads worldwide, up 22% versus the same month the year prior, capturing 29% of the market by lithium units deployed.

In second spot, NCM (nickel-cobalt-manganese) 5-Series (~50%-plus nickel content) cathode chemistries hauled 9,277 tonnes of LCE onto roads globally, up 29% year-over-year, while netting NCM 5-Series 24% of the market by lithium deployed.

In third place, NCM 8-Series (~80%-plus nickel content) powered 6,990 tonnes (18% market share) of LCE onto highways and byways in September 2023, up 13% year-over-year, followed by NCM 6-Series (3,261 tonnes) and NCM 7-Series (3,128 tonnes). NCM 7-Series just edged out NCA (nickel-cobalt-aluminum) batteries in September, which were responsible for 2,997 tonnes of LCE deployment during the month.

Collectively, high-nickel cell chemistries (i.e., NCM 6-, 7-, 8-, 9-, NCA, and mixtures thereof) captured 45% of the global market by lithium units deployed in September 2023, down from 46% the same month the year prior.

Adamas take:

Global BEV unit sales growth slowed in September 2023 to 13% year-over-year, bucking the historical trend of strong September growth. At least part of this lull is attributed to buyers waiting for delivery of the refreshed Tesla Model 3 Highland, which started in October.

Over the same period, global HEV sales rose 31% year-over-year in September 2023, suppressing growth of the average xEV’s pack capacity and thereby suppressing overall growth in demand for LCE.

With the fourth quarter historically being the seasonally strongest period of the year, and Tesla poised to ramp up deliveries of refreshed Model 3s, we expect LCE deployment to accelerate in through the end of the year for a record calendar quarter.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview