LFP contribution to global lithium demand sinks to 11-month low

LFP market share down

In February 2024, a total of 25,220 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally in the batteries of all newly sold passenger EVs, including conventional and plug-in hybrids, down 20% from January and up 6% from February 2023.

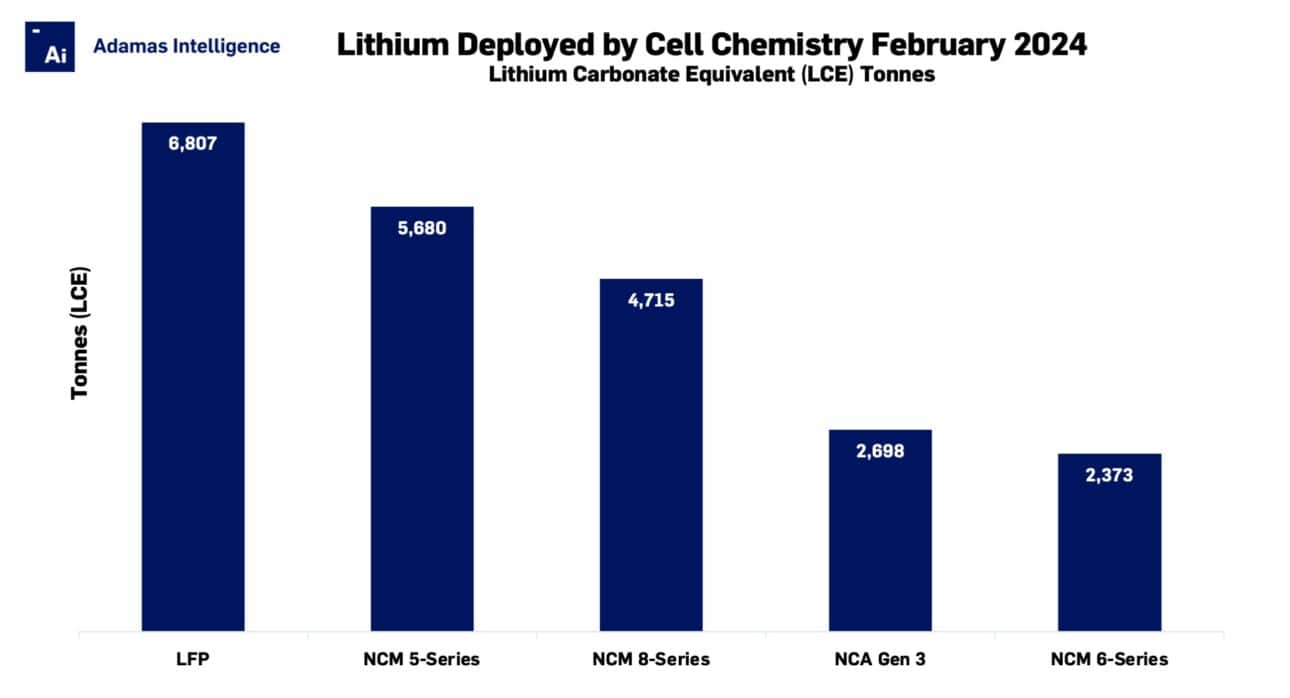

Lithium-iron-phosphate, or LFP batteries, led the pack in February, driving 6,807 tonnes of LCE onto roads worldwide, representing a substantial 31% drop month on month and up only a modest 3% compared to February last year.

LFP cell chemistries captured 27% of the global market by lithium units deployed, the lowest proportion since March 2023.

In second spot, NCM (nickel-cobalt-manganese) 5-Series (~50%-plus nickel content) cathode chemistries hauled 5,680 tonnes of LCE onto roads globally in February 2024, up 9% year-over-year, netting NCM 5-Series 22% of the market by lithium deployed.

In third place, NCM 8-Series (~80%-plus nickel content) powered 4,715 tonnes (19% market share) of LCE onto highways and byways in February 2024, up 7% year-over-year.

Third generation NCA (nickel-cobalt-aluminum) cell chemistries claimed position number four with 2,698 tonnes of LCE deployed, representing 11% of the market in February, followed closely by NCM 6-Series with 2,373 tonnes deployed.

NCA Gen-3 was the only cell chemistry among the top 5 which saw increased LCE deployment compared to January (up 7%), while year on year growth was an eye-catching 27%. Panasonic and Samsung SDI are the main global suppliers of these cells fitted primarily to Tesla, BMW and Rivian EVs.

Collectively, high-nickel cell chemistries (i.e., NCM 6-, 7-, 8-, 9-, NCA, and mixtures thereof) captured 47% of the global market by lithium units deployed in February 2024.

Adamas take:

The relative underperformance of LFP battery packs against ternary chemistries in February was a function of widely diverging global EV markets during the month.

In terms of combined battery capacity (GWh) deployed in newly-sold EVs, China’s market contracted by a holiday-driven 38% in February compared to the month before, and declined by 12% compared to February 2023.

While seasonal factors and the Lunar New Year slowed activity in China this February, the market behaved very differently in 2023 when Chinese holidays fell in January.

Consequently, the drop in February sales relative to January’s towering year-over-year growth has fed into the media’s bear narrative of a broader market slowdown.

LFP dominates the Chinese domestic industry with a market share in GWh over 50% while in the US, the cobalt-, manganese- and nickel-free chemistry enjoys less than an 8% share.

In the US, month-over-month growth came in at 6% in February while year-over-year the market expanded by 11%.

Over the same period, Europe’s top two markets – Germany and France, where ternary batteries dominate – posted double-digit percentage growth month-over-month.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview