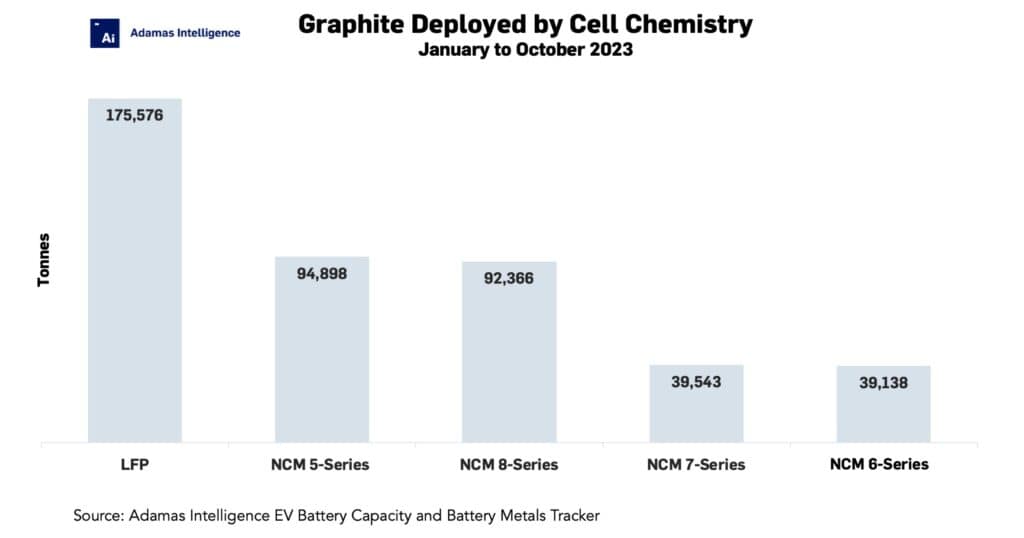

LFP now responsible for 36% of global EV graphite demand

NCM 6-Series loses market share

From January through October 2023, a total of 493,472 tonnes of graphite were deployed onto roads globally in the batteries of all newly sold passenger EVs (BEVs, PHEVs and HEVs) combined, up 45% or 153,034 tonnes from the same ten months in 2022.

This growth was driven by a 33% increase in passenger EV unit sales and a 9% increase in sales-weighted average battery capacity (in kWh) over the same period.

LFP led the pack from January through October last year, driving 175,576 tonnes of graphite onto roads worldwide, up 54% versus the same period in 2022, capturing 36% of the EV battery market by graphite units deployed, up from 33% the year prior.

In second spot, NCM (nickel-cobalt-manganese) 5-Series (~50%-plus nickel content) cathode chemistries hauled 94,897 tonnes of graphite onto roads globally, up 33% year-over-year, while netting NCM 5-Series 19% of the market by graphite deployed, down from 21% the year prior.

In third place, NCM 8-Series (~80%-plus nickel content) powered 92,366 tonnes (19% market share) of graphite onto the world’s highways and byways through the first ten months of 2023, up 53% over the same period the year prior, followed by NCM 7-Series with 39,543 tonnes deployed and NCM 6-Series with 39,137 tonnes deployed.

NCM 6-Series edged out NCA-powered (nickel-cobalt-aluminum) batteries for fifth spot through the first ten months of last year, the latter of which were responsible for 33,552 tonnes of graphite deployed onto roads during the same period.

Adamas take:

From January through October 2023, plug-in hybrid sales outpaced those of battery electric vehicles globally with the former growing at 49% year-over-year versus 31% for the latter.

While PHEVs generally have smaller capacity (kWh) batteries than BEVs, the average PHEV’s capacity surged higher in 2023 and with it average graphite use.

The average BEV’s battery capacity has also risen steadily – up 8% year-over-year versus the first ten months of 2022 – further increasing graphite use per average EV.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview