Global lithium deployment up 64% year-on-year in January 2024

Plug-in hybrids accelerate into 2024

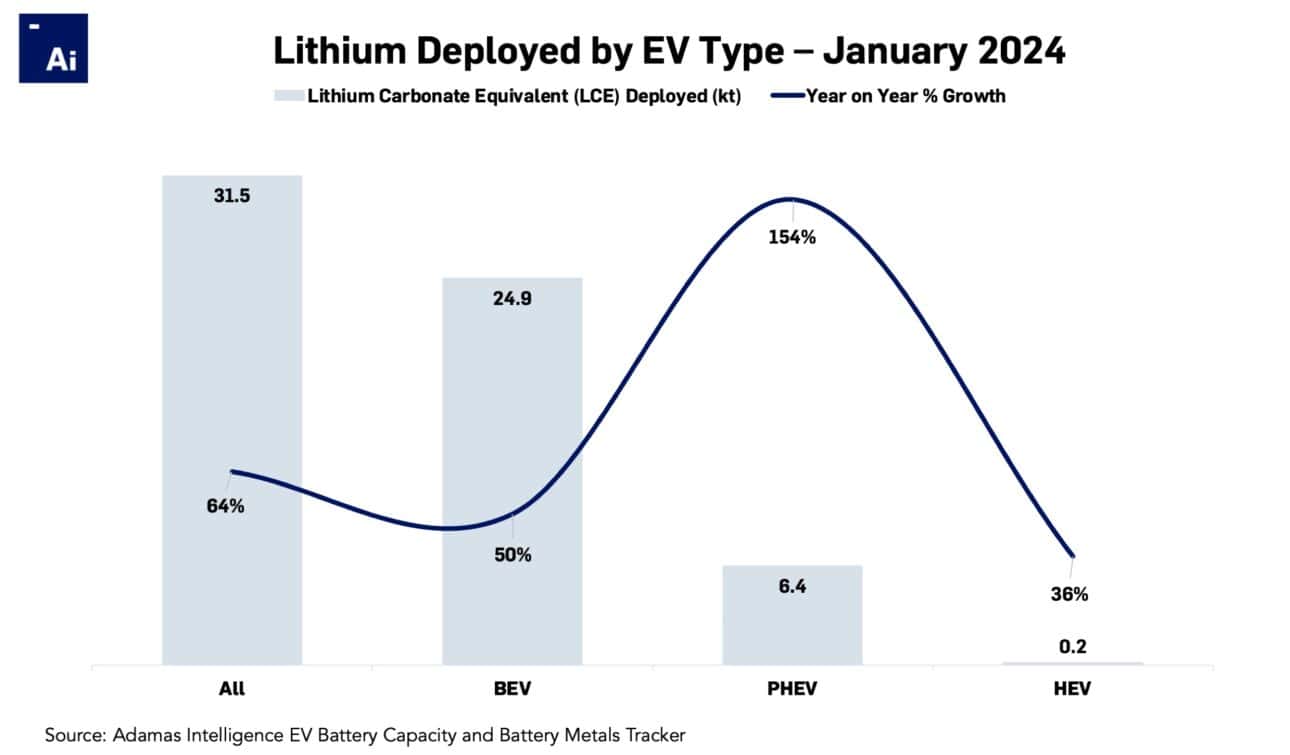

Globally, 31,526 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads in newly sold electrified vehicles in January 2024, representing a 64% (or 12,272 tonne) increase compared to January 2023.

Of this total, 73% (or 8,951 tonnes) was derived from lithium carbonate and the remaining 27% (or 3,321 tonnes) from lithium hydroxide in reflection of the relative underperformance of January EV sales outside China where carbonate-derived lithium-iron-phosphate (LFP) batteries dominate.

Passenger battery electric vehicles (BEVs) registered during the month were responsible for 24,900 tonnes of LCE deployed globally, an increase of 50% year-on-year.

Lithium use in plug-in hybrids (PHEVs) registered the greatest percentage increase among EV types with 6,435 tonnes of LCE deployed in January 2024, surging by 154% over the same month last year.

Naturally, conventional hybrid electric vehicles (HEVs) deployed the least LCE during January 2024 at a mere 191 tonnes, but this figure also represents a noteworthy year-on-year increase of 36% compared to January 2023.

Adamas take:

While the market has bounced back from lows at the end of 2023, benchmark lithium carbonate prices remain down nearly 40% in China and more than 55% below this time last year for the chemical compound delivered to Europe and the US.

The positive start to the year and rising battery deployment across the board fueled a boost in LCE deployment per average EV – up 9% year on year in January 2024 to 19.6kg. Collectively, this trifecta of growing EV sales, lithium deployment and lithium loading per EV adds further support for a rebounding lithium industry in 2024.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview