Fast Five: 5 Fastest Growing Battery Markets in Asia Pacific in June 2023

Despite its already formidable size, the EV market in China continues to grow at a healthy clip

China’s market for battery electric and hybrid vehicles dwarfs the rest of the world’s. At 3.6 million units in the first half of 2023, it’s three times the size of its closest rival, the U.S. And nearly four times that of the world’s number three market, Japan.

Strip out plug-in and conventional hybrids and China’s dominance is even starker.

According to the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker, which tracks battery and battery metals demand in over 110 countries, Chinese full battery electric vehicle (BEV) sales, in terms of the MWhs contained in those BEVs, are nearly four times that of the U.S.

In terms of BEV registrations, Japan, which after all gave us the Prius hybrid way back in 1997, is in a lowly 11th place on the world stage with fewer than 50,000 units finding buyers this year compared to just shy of 2.2 million Chinese flipping switches in brand new BEVs so far in 2023.

Despite its already formidable size, the electrified car market in China continues to grow at a healthy clip of 23% year-over-year.

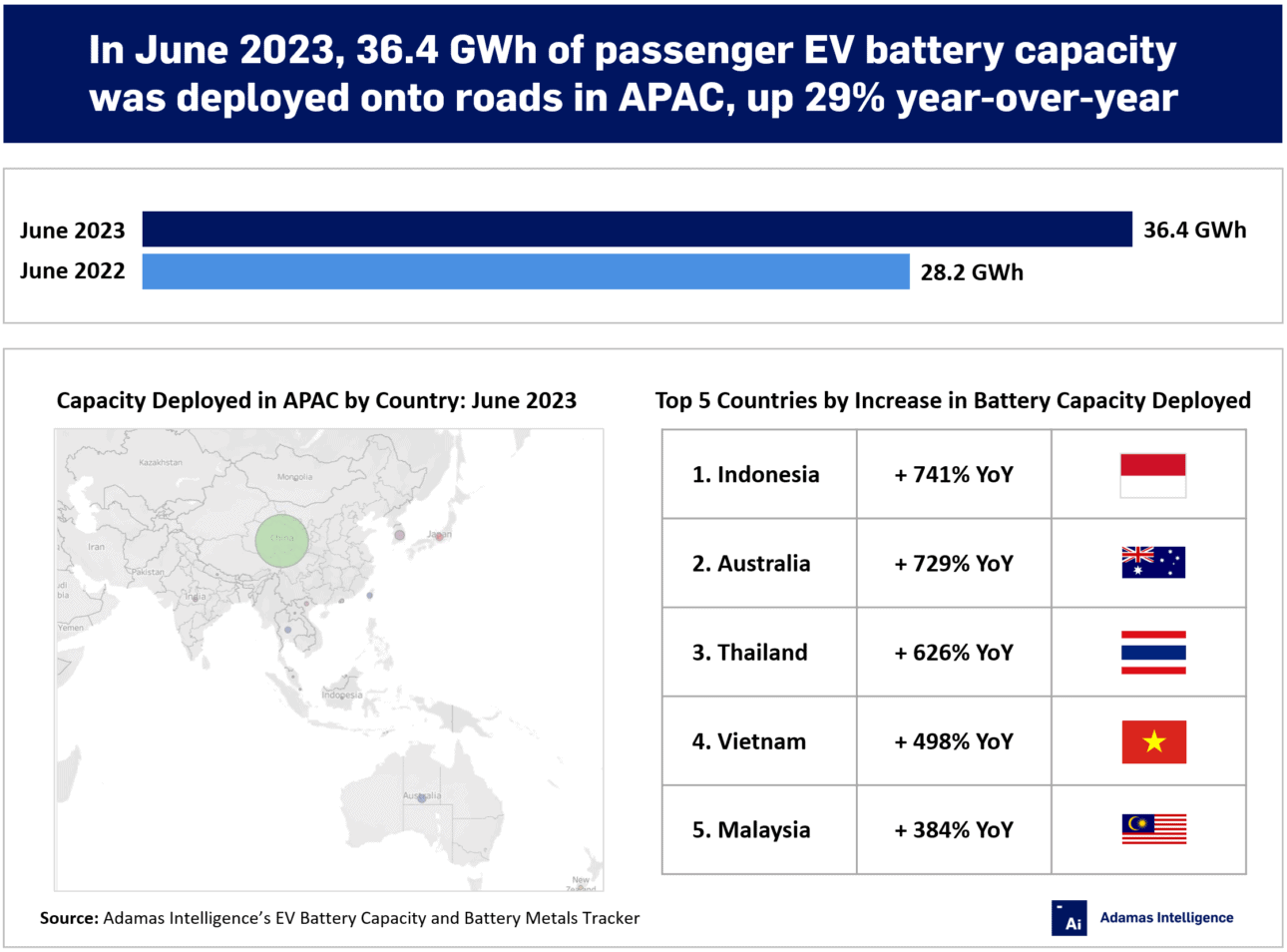

Other countries in the Asia Pacific region are going all out to catch up, although in every case it’s from a low base.

Indonesia, Australia and Thailand growing fastest

Adamas tracker data shows Indonesia is currently the fastest growing EV market in the region, deploying 741% more MWhs onto roads in June 2023 than the same month the year prior.

Australia’s growth is just as impressive given the continent’s EV market was already nine times the size of the nickel-rich archipelago’s this time last year. In June 2023, almost 780 MWh worth of battery power hit the roads down under, 729% more than in June 2022.

The vehicle mix in the top two countries is also vastly different with Indonesia so far relying almost solely on hybrids to electrify its car parc. Hybrids in the Asian nation of 275 million souls make up 66% of the overall EV sales mix with Toyota’s soulless Innova, an ageing three row multi-purpose vehicle, the best seller capturing more than half the market.

In Australia (population 25.7 million), the usual suspects, Tesla’s Model Y and Model 3, command 53% of the market and BEVs make up 90% of the sales mix.

The third fastest growing battery market is Thailand with a 626% jump in June this year and an overall market size (in MWh terms) around half that of Australia.

Next are Vietnam and Malaysia with growth of 498% and 384% year-over-year, respectively.

The most mature market in the Asia Pacific region after China is South Korea where north of 1 GWh of battery power hit the road in June. However, it grew by only 12% year-over-year, the laggard of the region.

Note: The above figure considers battery capacity (GWh) deployed onto roads in newly sold passenger EVs (HEVs, PHEVs, BEVs) globally. It does not consider working inventories of cells, packs and vehicles on assembly lines, at dealerships, or in transit. It also does not consider battery capacity installed or deployed in commercial vehicles (e.g., passenger busses), special purpose vehicles (e.g., garbage trucks), low speed electric vehicles, or electric bikes, scooters, mopeds, motorcycles, quadricycles, boats, aircraft or all terrain vehicles.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview