The average battery size of plug-in-hybrids is soaring

Automakers are increasing average battery pack capacity for all EV types, PHEVs especially

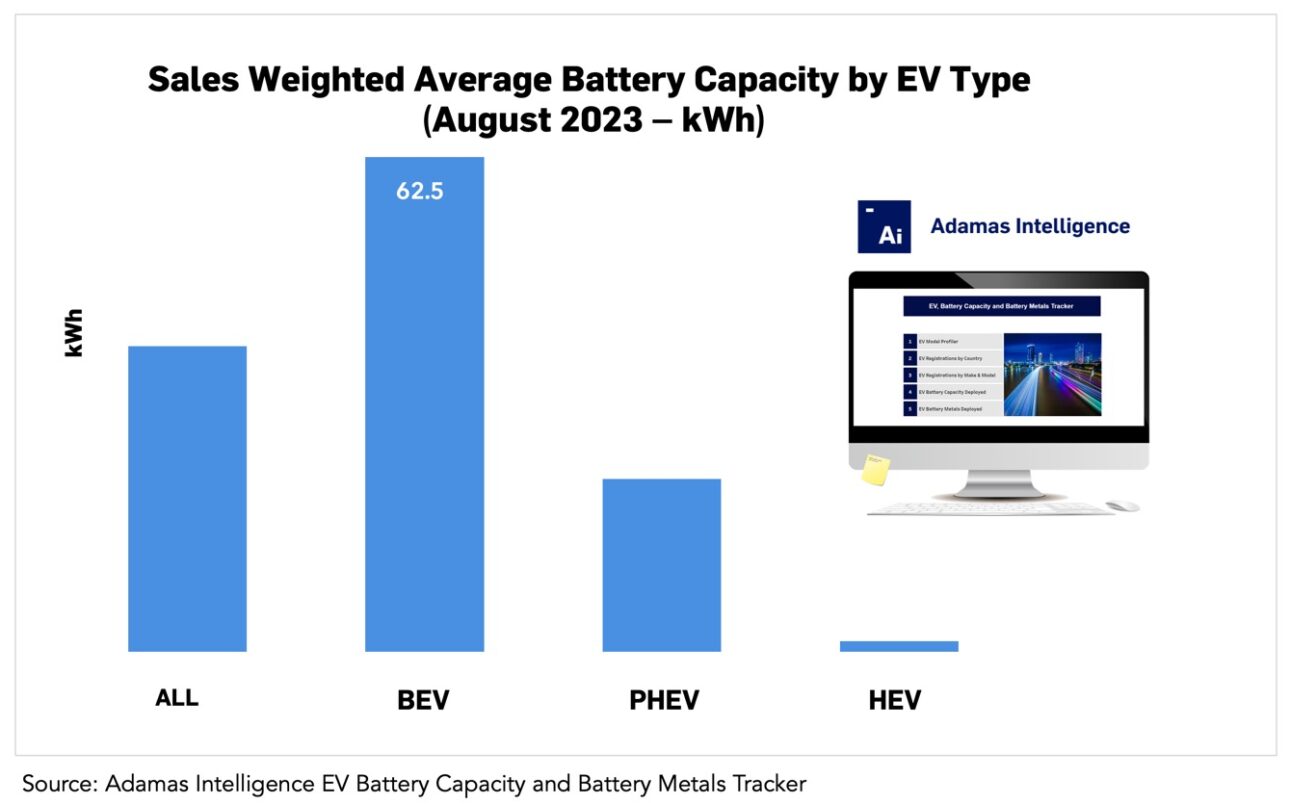

In August 2023, the average passenger EV sold globally, including BEVs, PHEVs and HEVs, had a battery capacity of 38.6 kWh, 9% higher than the same month a year ago according to the Adamas EV Battery Capacity Monthly intelligence service.

BEVs had an average battery capacity of 62.5 kWh in August 2023, which represents a less-than 1% increase over the previous month and an 8% leap compared to August 2022.

PHEVs had an average battery capacity of 21.8 kWh in August 2023, an 8% expansion compared to July 2023 and a massive 27% capacity increase compared to the same month last year.

HEVs had an average battery size of 1.3 kWh in August 2023, a slight increase over July 2023 and a 3% increase in capacity compared to August 2022.

Battery capacity growing faster than the overall market

Through the first eight months of 2023, just over 413 GWh of fresh battery capacity was deployed onto roads globally, a 50% jump compared to the same period last year.

By comparison, the growth rate of global EV sales over the same period is running well behind.

Year-to-date, sales of all EV types combined are up 35% but the sales mix is changing as PHEV sales in particular continue to outperform.

From January through August, global PHEV sales leapt 50% year-over-year. Chinese car buyers have become particularly fond of PHEVs, with the range-anxiety-allaying vehicles cornering 30% of the world’s largest electric car market so far this year.

Indeed, China’s best-selling EV in 2023 is a PHEV – the BYD Song Plus DM-i, which can drive over 1,000 kilometers without needing a charge or top-up of the gas tank.

PHEVs’ share in Europe so far this year is below 20% while in the Americas, counterintuitively given the still limited charging infrastructure across the region, the proportion of PHEVs in the sales mix is only 12%.

Adamas take:

A 50% rise in battery capacity deployed year-to-date on the back of a 35% rise in passenger EV sales is all the more notable when considering that PHEVs have captured market share over the same period. Were it not for a substantial increase in the average PHEV’s battery capacity in tandem, demand for cells and battery metals would have been further suppressed. With the growing use of LFP batteries already impacting nickel, cobalt and manganese suppliers, bigger batteries are at least softening the blow.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview