Electric carmakers continue to lighten their cobalt load

Cobalt use in average EV battery upheld only by rising pack size

Electric cars became the number one source of cobalt demand a couple of years ago, but the rapid adoption by carmakers – particularly in China – of lithium-iron-phosphate (LFP) cathode fitted batteries, which forego cobalt and nickel entirely, has dented prospects for the metal.

Rapid supply growth in the Democratic Republic of Congo – responsible for more than two-thirds of global output – only adds to the weak fundamentals for the base metal. Given the size of the market –around 180,000 tonnes were produced in 2022 – any additional supply can have a significant influence on prices. From a peak near $100,000 a tonne five years ago, the metal is now in danger of slipping below $30,000 a tonne.

And with many cell makers continuing to maximize nickel loadings at the expense of cobalt concentrations, the blue metal’s use in lithium-ion batteries (and specifically those with nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) cathodes) continues only to be upheld by rising average pack sizes (in kWh).

Cobalt is getting ratioed

Thrifting of the metal in NCM batteries has been ongoing. The NCM cathode of choice in 2023 has an ~8:1:1 split of these metals and captured nearly 20% of the market (by GWh deployed) through the first seven months of the year, followed by NCM 5-Series and Tesla-Panasonic’s third generation NCA battery.

Early NCM cells used nickel-cobalt-manganese in a ~1:1:1 ratio, but now this mix only commands 1% of the market in terms of GWh deployed globally, the Adamas Intelligence EV Battery Capacity and Battery Metals Tracker shows.

In July 2023, Adamas data indicates that the average EV sold globally (including plug-in and conventional hybrids) contained 2.9 kilograms of cobalt – unchanged from the same month the year prior – and sustained only by a 10% rise in average EV pack capacity over the same period, from 32.4 kWh to 35.6 kWh, that helped offset cobalt thrifting per-kWh overall. In contrast, nickel use per average EV battery jumped 8% year-over-year in July of this year.

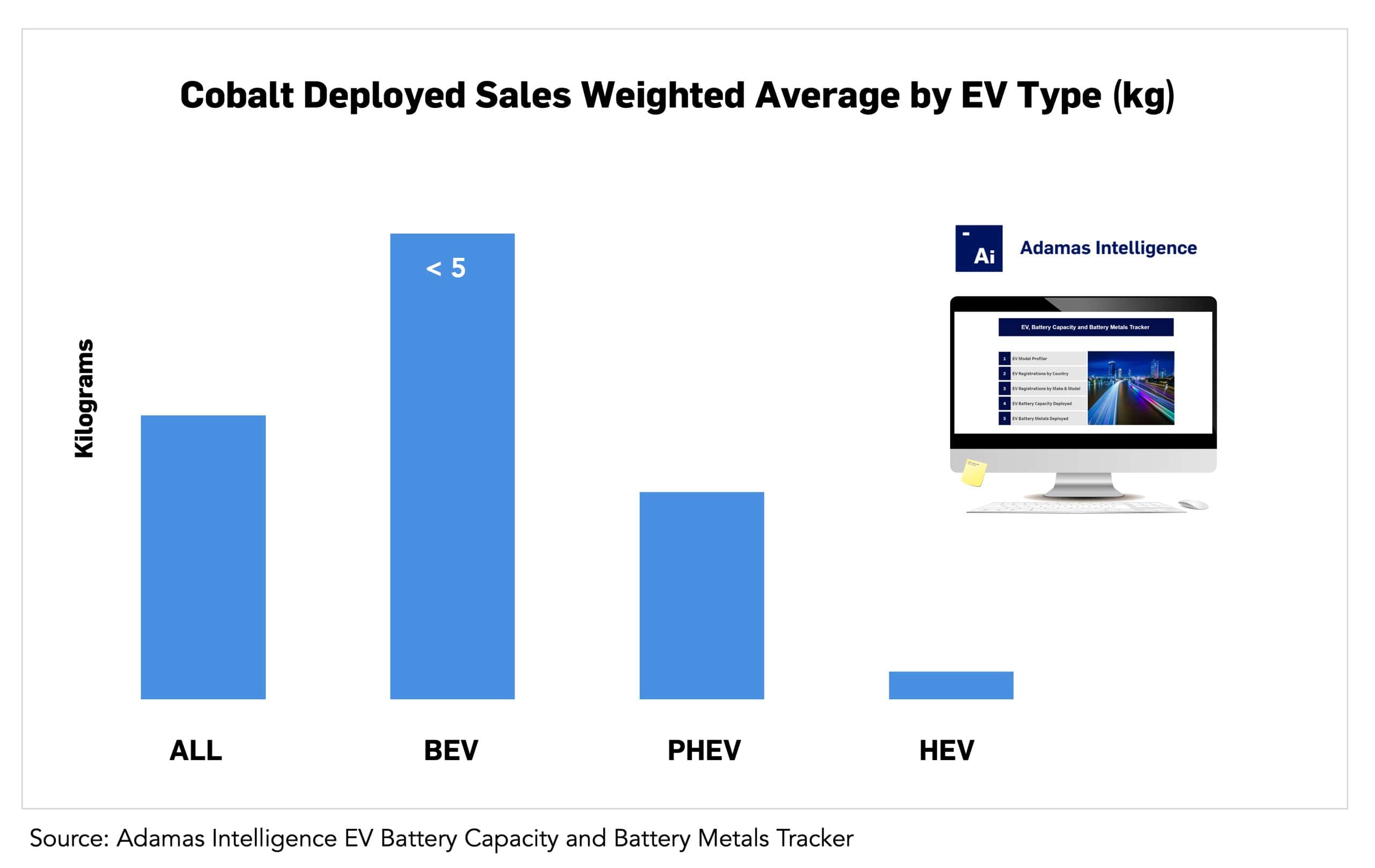

By EV type, a similar divergence is seen in both full electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), whereby cobalt use is down and nickel use up per average EV.

In the case of BEVs, which constitute 82% of EV battery cobalt demand overall, the average unit sold globally in July 2023 contained 4.8 kilograms of the blue metal, down 1% from the same month the year prior.

Similarly, in July 2023 the average PHEV sold globally contained 2.1 kilograms of cobalt in its battery, down 3% from July 2022.

Conversely, in July 2023 the average HEV sold globally contained 0.3 kilograms of cobalt in its battery, up 8% versus the same month the year prior in reflection of a gradual increase in Li-ion market share (and decrease in NiMH) for HEVs.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview