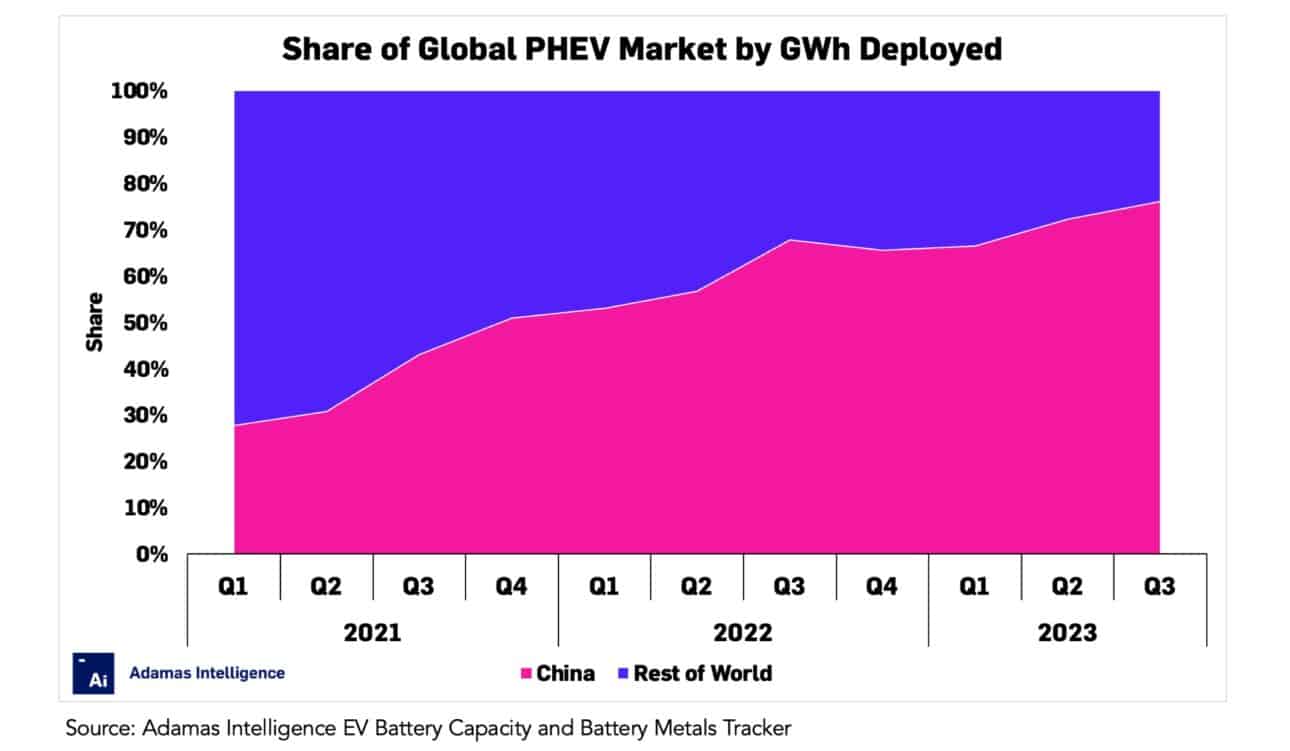

China triples share of global PHEV market in less than 3 years

Long range view of Chinese EV market

In Q3 2023, 76% of all battery capacity (GWh) deployed onto roads globally in newly-sold plug-in hybrids (PHEVs) was registered in China, up from just 28% in Q1 2021 as PHEV sales and average pack capacity (in kWh) continue to surge in tandem.

Two OEMs in particular – BYD and Li Auto – are leading the growth of China’s PHEV market by a long shot.

Adamas take:

From the Seal to the Destroyer, BYD offers a growing portfolio of PHEV models across segments and price points that have proven especially popular in China, driving PHEV unit sales steadily higher.

In the case of Li Auto, its popular range extender PHEVs with beefed up battery packs – some upwards of 44 kWh – have contributed to an ongoing rise in the sales-weighted average PHEV’s pack capacity in China over the same period.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview