Charts: China’s global electric car dominance

EV impetus

As if the Chinese EV market was not expanding at a breakneck pace already, Beijing this month relaxed new vehicle financing rules and axed 15% downpayment requirements in place since the beginning of 2018.

It’s just the latest incentive intended to spur already red hot demand in the world’s largest vehicle market and dominant global EV manufacturer and exporter.

In December, Chinese regulators unveiled new technical requirements for EV tax breaks, setting the bar low enough that over 90% of electrified passenger vehicles sold in the country will qualify. The country’s EV incentive package, worth a total of $72 billion, runs until 2028.

Unlike the US, under the Chinese rules, the price of a vehicle does not alter the eligibility for tax breaks, and average selling prices in China are already some 50% below US MSRPs for comparable models.

And that was before the latest price war sparked by BYD, the world’s top EV manufacturer by volume and the only major vertically integrated battery maker. Last month BYD slashed the price of its subcompact BEV to 69,800 yuan, or $9,700, forcing competitors to follow suit in the cutthroat Chinese market.

Apart from bargain prices – thanks in no small part to its control of the mine-to-megawatt EV supply chain – Chinese tire kickers can choose from over 100 brands and a panoply of models and variants often shot through with technology not found in EVs from legacy automakers in the rest of the world.

Pulling away

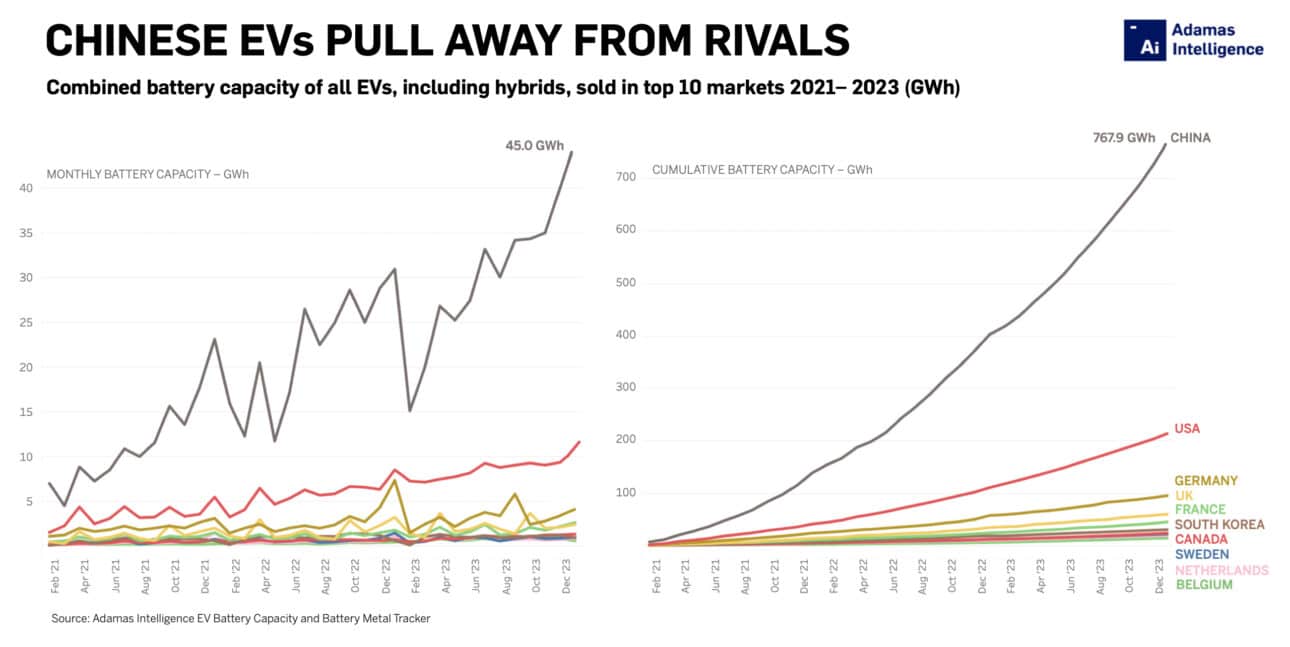

Put it all together and you have numbers like these showing the level of command China has over the global full-electric (BEV) and plug-in hybrid (PHEV) passenger vehicle markets:

In 2023, China was responsible for 58% of the 13.7m passenger BEVs and PHEVs sold globally. That’s five times the size of the US market and seven times that of the world’s third largest EV market, Germany. Despite the size of China’s EV market, EV penetration rates in the country reached 22% last year, versus 15% in the US, excluding conventional hybrid electric vehicles (HEVs).

PHEVs have been rapidly growing in popularity in China and sales of these range extenders surged by 76% inside the country last year compared to a more sedate BEV expansion of 20%. Even so, when counting only BEVs, Chinese buyers still bought every other entirely non-gasoline powered vehicle sold worldwide last year.

Charged up

Using the combined battery capacity of EVs sold last year, which provides a fuller picture of the electrification rate of a country’s vehicle fleet, China’s performance is no less impressive.

Even though PHEVs, which have inherently smaller batteries than BEVs, captured an imposing 30% of the Chinese market last year, total GWhs hitting roads in the country still represented 53% of the global total.

And that is up from 48% in 2021 and comes despite Western governments’ and automakers’ trillion-dollar efforts to catch up (and stifle Chinese EV makers’ progress).

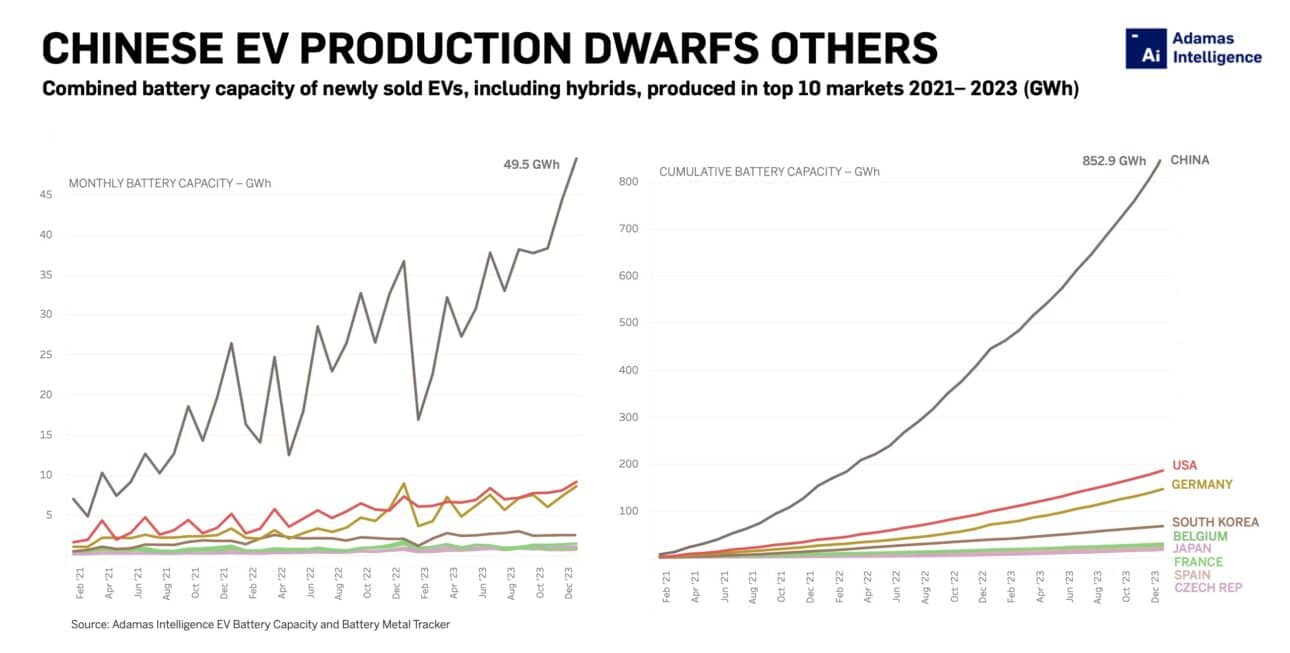

When considering country of EV manufacture, China’s share of the global market in terms of GWh deployed only grows. At 408.9 GWh in 2023, 59% of all power-hours rolled onto roads globally last year were in China-made cars, including non-Chinese brands like Tesla, Dacia, BMW and others.

China was an exporter of 49.5 GWh of installed battery power to the rest of the world in 2023, mostly to Europe and the UK.

Over the same period, the US imported 28.8 GWh of installed battery capacity to meet EV demand inside the country. The US also exported 13.6 GWh of battery power leaving net imports at 15.2 GWh for the year.

Notably, Germany’s exports of installed battery power was greater than China’s at 58.5 GWh last year, but in contrast, Europe’s number two market last year by GWh deployed, the UK, exported only 2.2 GWh.

Speeding up

Speeding up

While the rest of the EV world coasted into the new year, China’s EV industry was throwing its weight around even more.

In GWh terms China grew the size of its EV parc in January 2024 at more than twice the rate it did the year before with every third passenger vehicle sold during the month electrified.

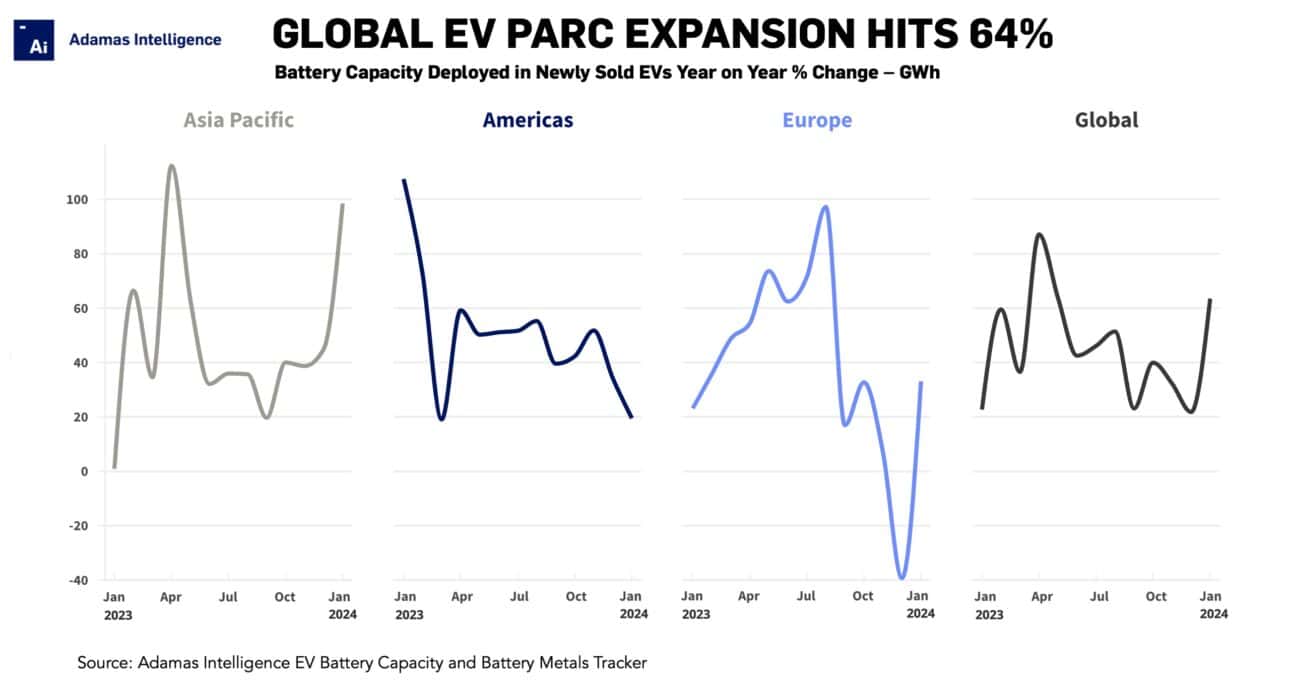

At 30.2 GWh, the country was responsible for 57% of total battery capacity deployment during the month, lifting global battery capacity deployment in January to 64% year on year.

In terms of manufacture, China also sprinted into the new year. At 33.9 GWh, made-in-China passenger EVs represent more than 63% of the world’s fresh battery power steered onto roads.

RELATED: EV parc in China growing 10 times faster than in US

*Note: To produce the most accurate and granular insights, Adamas Intelligence’s analysis is based on end-user vehicle registrations and retail sales, not extrapolations of production data, wholesale car markets, sales to dealerships or preliminary sales projections.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview