At a glance: CATL’s EV battery dominance

Powering ahead of contemporaries

Contemporary Amperex Technology Co (CATL) said this week preliminary net income for 2023 could come in as high as $6.3 billion – a whopping 48% year-on-year increase and above many analysts’ already rosy expectations.

CATL is listed on the Shenzen Stock Exchange where it has a $94 billion market value, and despite delivering fat profits the stock is trading more than 40% below its 52-week high.

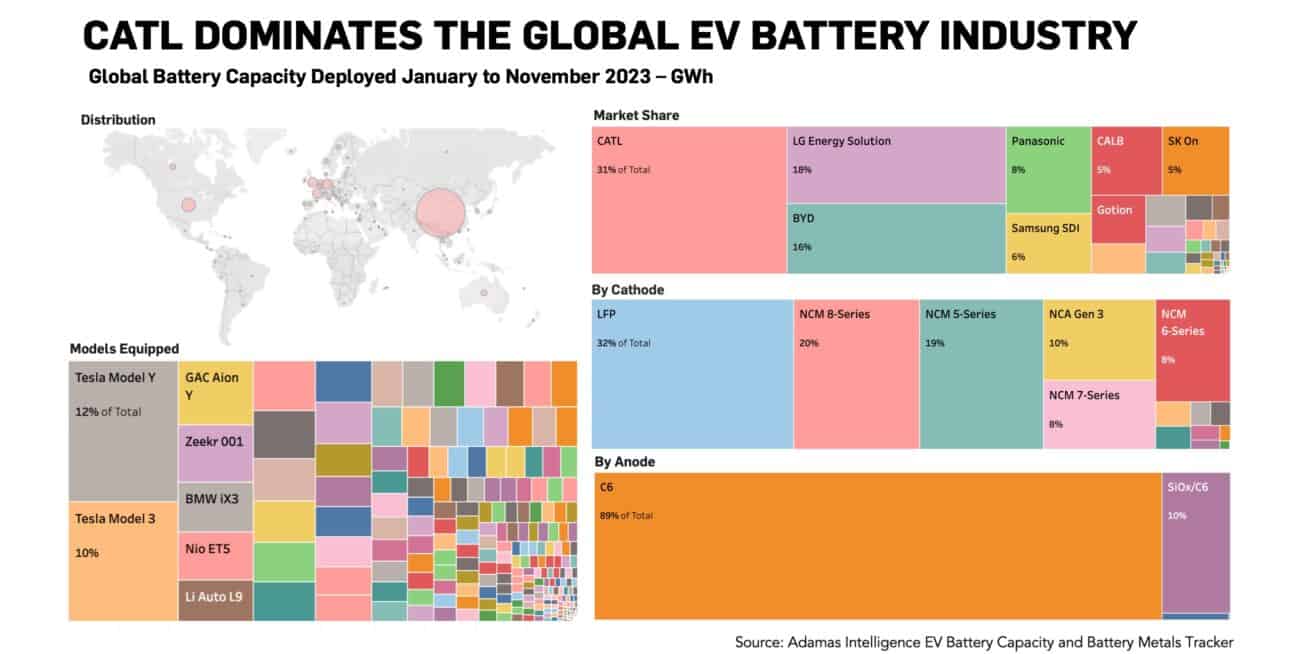

According to Adamas data, through the first eleven months of 2023 CATL cornered 31% of the global market by battery capacity (GWh) deployed onto roads in newly sold passenger EVs, growing its deployment by 34% year-on-year in the process.

When the data for December – typically the strongest month for EV registrations by a wide margin – rolls in CATL will have added an estimated 210 GWh-plus to the global EV parc in calendar 2023. To put that into perspective, in 2020, all the world’s battery manufacturers together supplied a total of just 135 GWh to EV makers.

In China, CATL’s position is even more dominant with 43% of the power-hours installed in new EVs in the country this year created in the Fujian province-based company’s factories.

US wants to corral CATL

Lawmakers this week called on the Biden administration to investigate CATL and its involvement with Ford Motor Company’s battery factory under construction in Michigan, according to a Reuters report.

A letter from the chairs of the select committee on China and Energy and Commerce accused CATL and three other companies of having direct ties to the Chinese military and communist party, the North Korean dictatorship and human rights abuses in China’s Xinjiang region.

The allegations were based on confidential documents supplied by Ford and at stake is the generous taxpayer subsidies Dearborn was able to procure for the factory set to start production in 2026.

In November Ford scaled back plans for the BlueOval plant, shrinking the nameplate capacity to 20 GWh from 35GWh before and cutting capital outlays by $1.5 billion to $2 billion.

Ford made much of the fact that the plant would produce lithium iron phosphate (LFP) batteries when it launched the investment, saying the cell technology allows it to “scale more quickly, making EVs more accessible and affordable.”

In the US, CATL occupies third place among cell suppliers and 60% of the company’s cells deployed in the country can be found in the Tesla Model 3 – specifically, the LFP-powered version. CATL also equips, among others, some Mercedes and BMW models sold in the US.

RELATED: Dearborn restarts work on a much-reduced BlueOval battery park

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview