Canada Nickel plans 80ktpa plant amid surging EV demand

Samsung SDI backing

Canada Nickel, which is advancing a nickel mining project in the Timmins area of Ontario, said this week it is looking to raise $1 billion to build a nickel processing plant in the emerging nickel district, approximately 300 km north of Sudbury.

The facility is expected to begin production in 2027 and process 80,000 tonnes of nickel annually according to Netzero Metals, a subsidiary of Canada Nickel. A second plant in the region will produce stainless steel and other alloys.

CEO Mark Selby said the company is in discussions with the Canadian government, the US Department of Defense and others to raise capital for the project.

In January, Samsung SDI invested $18.5 million for an 8.7% stake in the TSX Venture Exchange listed company. Canada Nickel is worth $172 million after a 25% jump in its stock price so far this year.

The Korean battery maker also secured rights to purchase a 10% equity interest in Canada Nickel’s Crawford project for $100.5 million, including offtake rights to the proposed mine’s nickel and cobalt output upon a final construction decision.

“The car companies and battery supply chain know that the amount of nickel needed in North America is going to double and triple over the next decade,” Selby told Reuters, adding that what these buyers want is responsibly produced, clean, green nickel produced in North America.

Global nickel deployment surging

Despite fast-growing demand from the EV industry, nickel prices have been in a deep slump with the metal traded on the LME down 40% over the past year, exchanging hands for just over $16,000 a tonne this week.

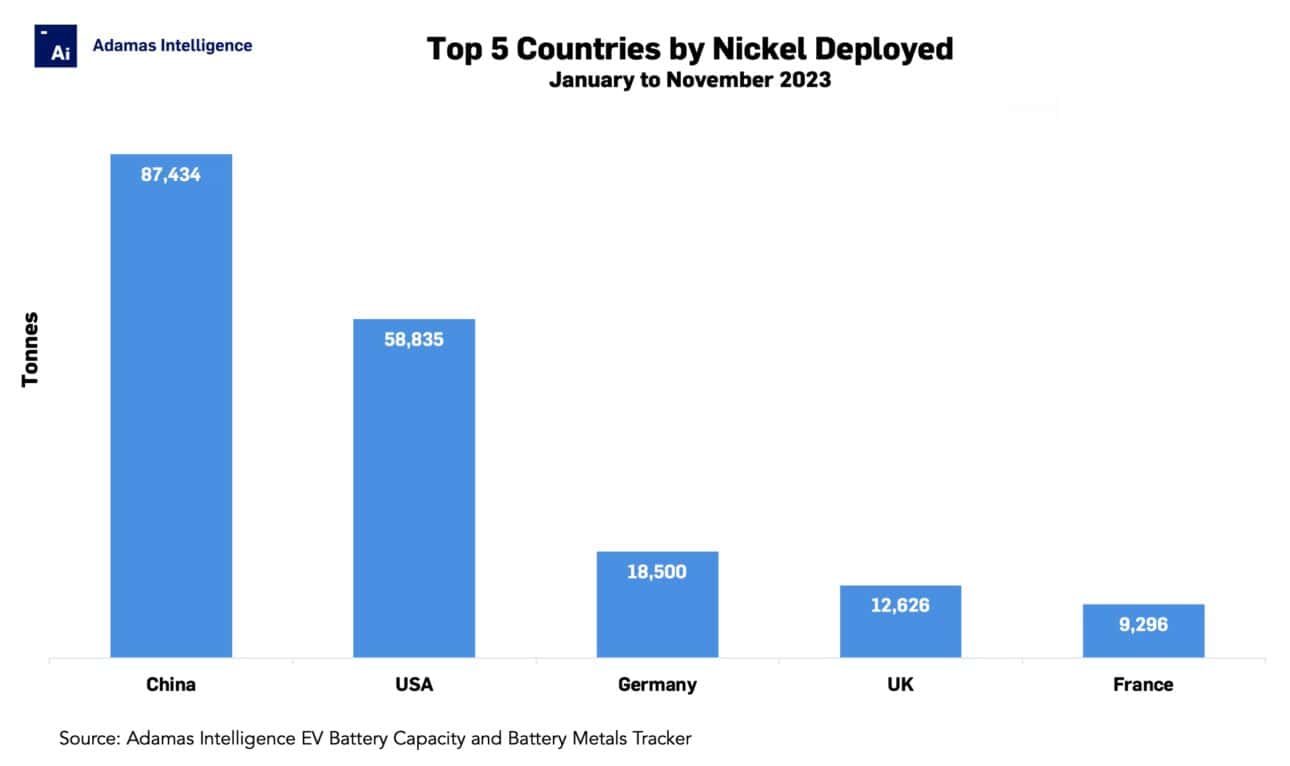

According to Adamas data, through the first 11 months of 2023 a total of 253,648 tonnes of nickel were deployed onto roads in the batteries of newly sold passenger EVs worldwide, a sizeable 40% increase over the same period of 2022.

Through the first 11 months of last year, China led the pack by nickel deployed at 87,434 tonnes, a 27% increase compared to the same period of 2022.

China’s share of global passenger EV nickel deployment fell to 34% last year from 38% the year prior, a testament to the growing use of LFP batteries in the country.

The US was ranked second with 58,835 tonnes of nickel hitting roads from January through November 2023, up 50% compared to the same period in 2022.

Unlike China, the US increased its share of global passenger EV battery nickel deployment to 23% last year, up from just under 22% during the first 11 months of 2022.

North of the border, the batteries of EVs sold in Canada during this period contained a combined 4,566 tonnes of nickel, an increase of 1,103 tonnes or 32% year on year, Adamas data shows.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview