BMW and Mercedes average battery capacity surges

Average battery capacity deployed by top 5 OEMs diverge year-on-year

Tesla topped the tables for battery capacity deployed in newly-sold EVs in July 2023 with 8.9 GWh powering the Texas-based company’s four models hitting roads during the month.

Tesla’s market share in July 2023 was 16% of total battery capacity deployed worldwide, followed by BYD with 15% after the Chinese company deployed a total of 8.2 GWh during the month.

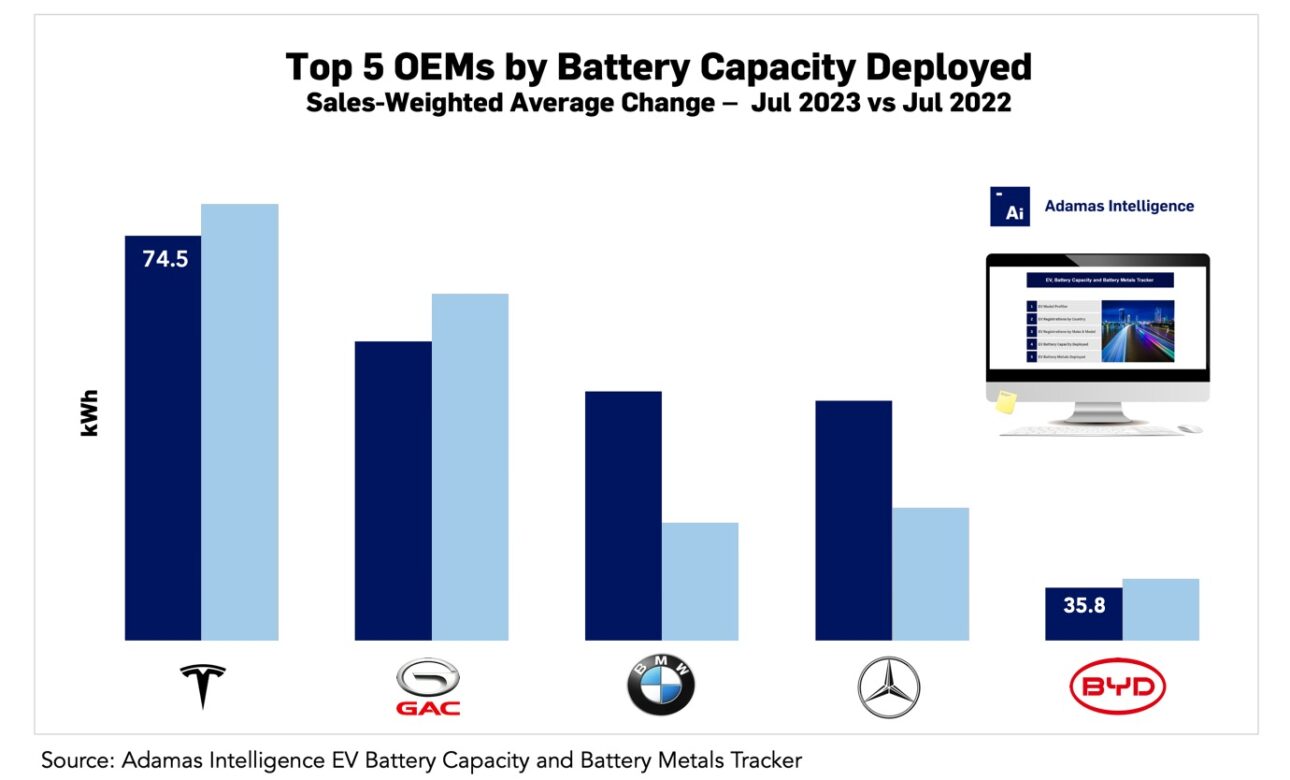

Among the top 5, Tesla also had the highest sales-weighted average (SWA) battery capacity at 74.5 kWh, but that figure decreased by 4.5% from July 2022 as buyers migrate more towards standard range entry level vehicles.

BYD had the lowest SWA battery capacity in the top tier after a 2.7% decline to 35.8 kWh, a reflection of the fact that the Shenzhen-headquartered company relies on plug-in hybrids for roughly half its sales.

Guangzhou Automobile Group (GAC) placed third in July this year with a total of 2.9 GWh deployed, representing 5% of global EV battery capacity deployed during the month. GAC’s SWA battery capacity, at 62.9 kWh, was down 7.6% in July 2023 compared to the same month last year..

The battery capacity rolled onto roads in vehicles sold by BMW in July 2023 totaled 2.1 GWh, placing the automaker ahead of Mercedes, which came in at number five with 1.8 GWh deployed during the month, granting the German luxury vehicle manufacturers 5% and 4% of the market, respectively.

From July 2022 through July 2023, BMW and Mercedes increased their SWA battery capacity by 14.5 kWh (up 33%) and 11.8 kWh (up 26%), respectively, a reflection of the rising proportion of battery electric vehicles (BEVs) in each manufacturers’ sales mix.

Registrations and battery capacity both increasing

The total battery capacity in all newly-sold EVs in July 2023 was 54.9 GWh, which was 14% lower than June 2023 (64.1 GWh) but 46% higher than July 2022 (37.6 GWh).

The strong year-over-year increase in battery capacity deployment came not only on the back of a surge in total EV registrations around the world, but was also driven higher by a rise in the average EV’s battery pack capacity over the same period.

From July 2022 through July 2023, the global sales-weighted average (SWA) pack capacity increased by just under 10% overall, from 32.4 kWh to 35.6 kWh, Adamas data shows.

This figure includes BEVs, plus plug-in and conventional hybrids (PHEVs and HEVs). PHEVs’ average battery capacity grew the fastest, reaching 20.2 kWh in July this year, a 14% increase from July 2022.

Adamas take:

Given the well-established seasonal pattern on EV markets of an acceleration in sales towards the end of the year coupled with a trend towards higher pack capacities, Adamas expects 2023’s annual total deployment to exceed 700 GWh for the first time ever, more than 45% higher than the year prior.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview