US battery nickel demand up 49% in 2023

LFP market share in US in retreat

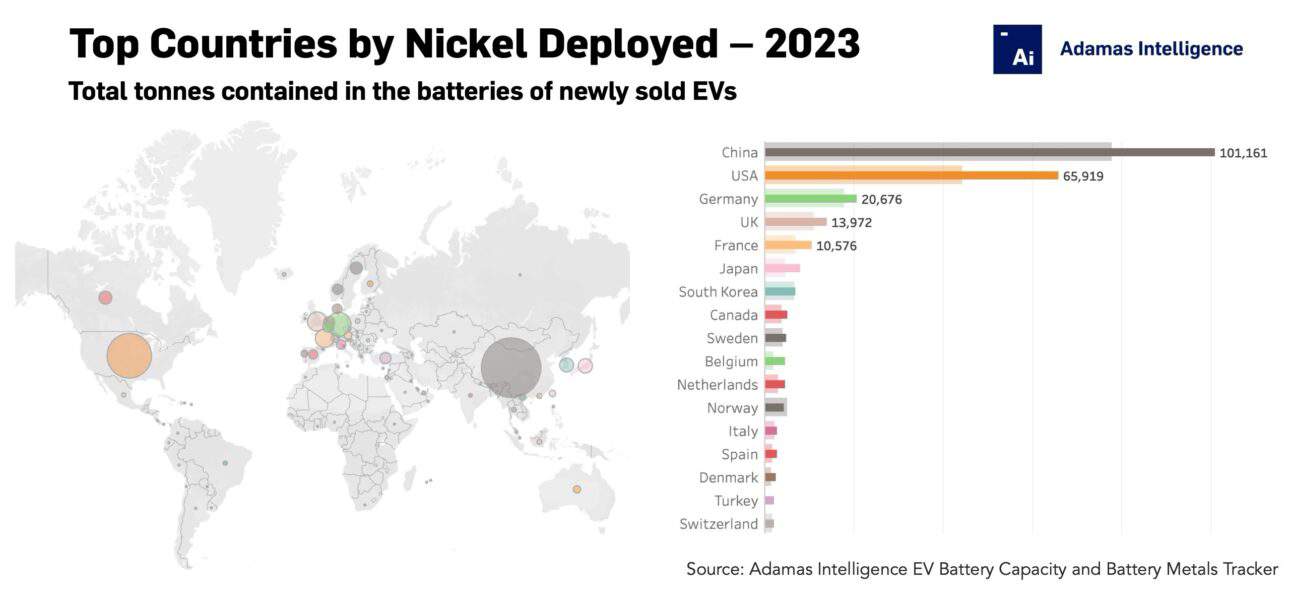

In 2023, a total of 286,529 tonnes of nickel were deployed onto roads in the batteries of newly sold passenger EVs, including plug-in and conventional hybrids, worldwide, a sizeable 37% increase compared to 2022, Adamas data shows.

By country, China deployed the greatest amount of nickel in newly sold EV batteries last year at 101,161 tonnes, up 30% over 2022. China, responsible for almost every second EV sold around the world last year, underperformed global deployment growth last year and consequently its share of the global EV battery nickel market fell from 37% to 35%.

The US was ranked second with 65,919 tonnes of nickel hitting roads over the 12-month period, up 49% compared to 2022. With US growth outpacing global nickel deployment growth last year, the nation’s share of the EV battery nickel market increased from 21% to 23%.

In China, nickel-free LFP batteries captured 51% of the market last year by GWh deployed versus just 8% in the US (down from 9% the year prior), where most OEMs to-date have maintained an affinity for high-nickel NCA and NCM batteries. In fact, LFP’s market share in the US is currently only being upheld by strong sales of Tesla Model 3s equipped with made-in-China cells.

In third, Germany deployed 20,676 tonnes of nickel onto autobahns last year, up 15% year-on-year, representing 7% of the global total, down from 9% in 2022. LFP is also underrepresented in Germany, making up 6% of the cathode mix by GWh deployed last year.

In fourth, the UK deployed 13,972 tonnes, up 24% over 2022. France rounded out the top 5 with 10,576 tonnes of nickel deployed last year, a 49% jump year-on-year despite LFP’s share of the French market jumping from 7% to 11% over the same period.

Adamas take:

Nickel-free LFP batteries continue to displace NCM and NCA cathode chemistries in China, but elsewhere the uptake of LFP has been slow due to a lack of manufacturing capability.

Nickel demand is also being boosted by an ongoing shift to high-nickel NCM and NCA cathode chemistries. Last year, Adamas data shows that NCM and NCA batteries containing 80%-plus nickel captured 30% of the global market by GWh deployed, up from 28% the year before.

The renewed popularity of conventional hybrids, often fitted with nickel-metal hydride (NiMH) battery packs, is also providing some support for nickel demand.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview