Lithium prices bounce on cracks in Chinese supply

Double digits

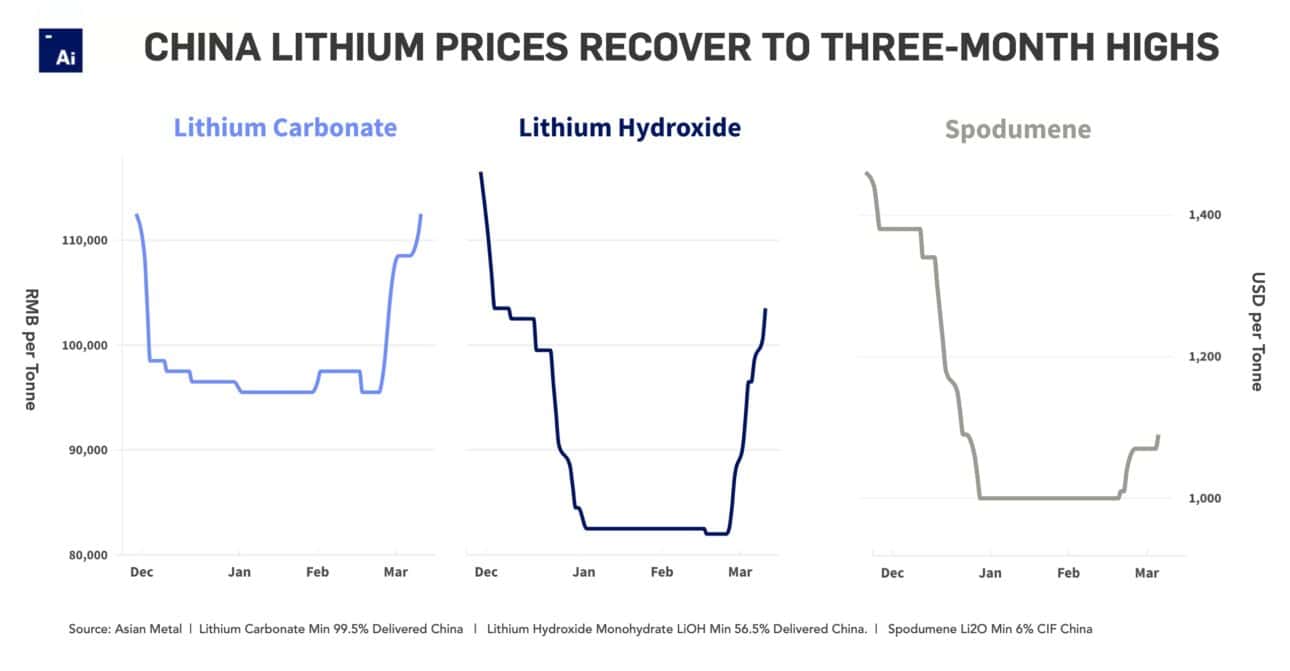

After a brutal 2023 that saw prices collapse from record highs the year before, 2024 has ushered in something of a recovery for lithium markets.

In China, the price setter for global lithium, prices have reached three-month highs with lithium carbonate up 16.5% and hydroxide jumping 25.5% from January lows.

Ex-works China, lithium carbonate traded at a midpoint of RMB 112,500 ($15,700) per tonne this week while hydroxide, up 8.5% just in March so far, exchanged hands for RMB 103,500 ($14,400) per tonne.

The revival in spodumene exported to China has been less auspicious but a decisive move out of triple digits to $1,100 this week will provide some comfort to Australian hard rock producers, responsible for half the world’s total lithium output.

The bounce, which some bears are already calling a dead cat, comes as Chinese traders restock after the lunar new year holidays on hopes of another record year for EV sales amidst a price war, and disruption to domestic Chinese supply resulting from environmental crackdowns in Jiangxi province, the hub of lepidolite production.

LFP drives carbonate

Adamas Intelligence data shows that a combined total of 408,214 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally last year in the batteries of all newly sold passenger EVs combined, a 40% increase over 2022.

Of this total just under 59% was in the form of lithium carbonate and 41% was in the form of lithium hydroxide.

The Asia Pacific region drove 77% of global lithium carbonate consumption last year, a small increase over the year before, and 32% of global lithium hydroxide consumption, below the annual hydroxide use of Europe for the first time.

In Asia Pacific, LFP batteries made up 48% of the combined GWh deployed in newly sold EVs last year, hence the region’s dominance of global lithium carbonate use.

As with lithium chemicals, prices for lithium iron phosphate (min 3.9% Li) in China are also rebounding, hitting highs of RMB44,500 ($6,200) per tonne this week, up by double-digits from January lows, according to Asian Metal.

Adamas take:

In many ways lithium prices were due for a relief rally given their precipitous declines through late 2023 in the face of otherwise strong demand.

This year’s post lunar new year reflation, a popular trade by any measure, also coincided with several lithium supply cut announcements and Jiangxi’s environmental inspections, providing ample narrative to support the move.

That said – the staying power of this upward momentum remains to be seen while the ink is still drying in the news.

Jiangxi’s environmental inspections are still ongoing, though historically these have had minimal effect on lithium supply.

Supply cuts are expected to be supportive of prices, though their effect takes times, all while several major projects and expansions will continue to come online into 2024.

Recent months have seen the the market’s production/demand fundamentals tighten at healthier levels, but more relevant at the moment are inventory levels across the mine to motorway supply chain.

Market participants and industry sources suggest that 2023’s inventory buildups are being drawn down. In light of strengthening fundamentals, today’s historically attractive price levels should encourage strategic buying in the weeks ahead.

With many moving parameters to assess, some of which are conflicting, it is looking increasingly likely that 2024 will be a transitional year for the global lithium industry, a year marked by growing pains as it continues to mature.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview