In 2023 Europe consumed more lithium hydroxide than Asia Pacific

Regional split

In 2023, a total of 408,214 tonnes of lithium carbonate equivalent (LCE) were deployed onto roads globally in the batteries of all newly sold passenger EVs combined, including plug-in and conventional hybrids, a sizeable 40% increase over 2022, Adamas data shows.

Of this total just under 59% or 239,632 tonnes was in the form of lithium carbonate and 41% or 168,582 tonnes was lithium hydroxide.

Regionally, a booming 59% of all lithium units deployed globally last year were contained in the batteries of EVs sold in the Asia Pacific region, unchanged from the year prior 2022.

Europe’s share of lithium unit deployment fell to 24% last year from 26% the year prior, while that of the Americas rose to 16% from 15% in 2022.

Combined, the Middle East and Africa nearly doubled its share of lithium unit deployment last year but remains a tiny proportion of the global market overall.

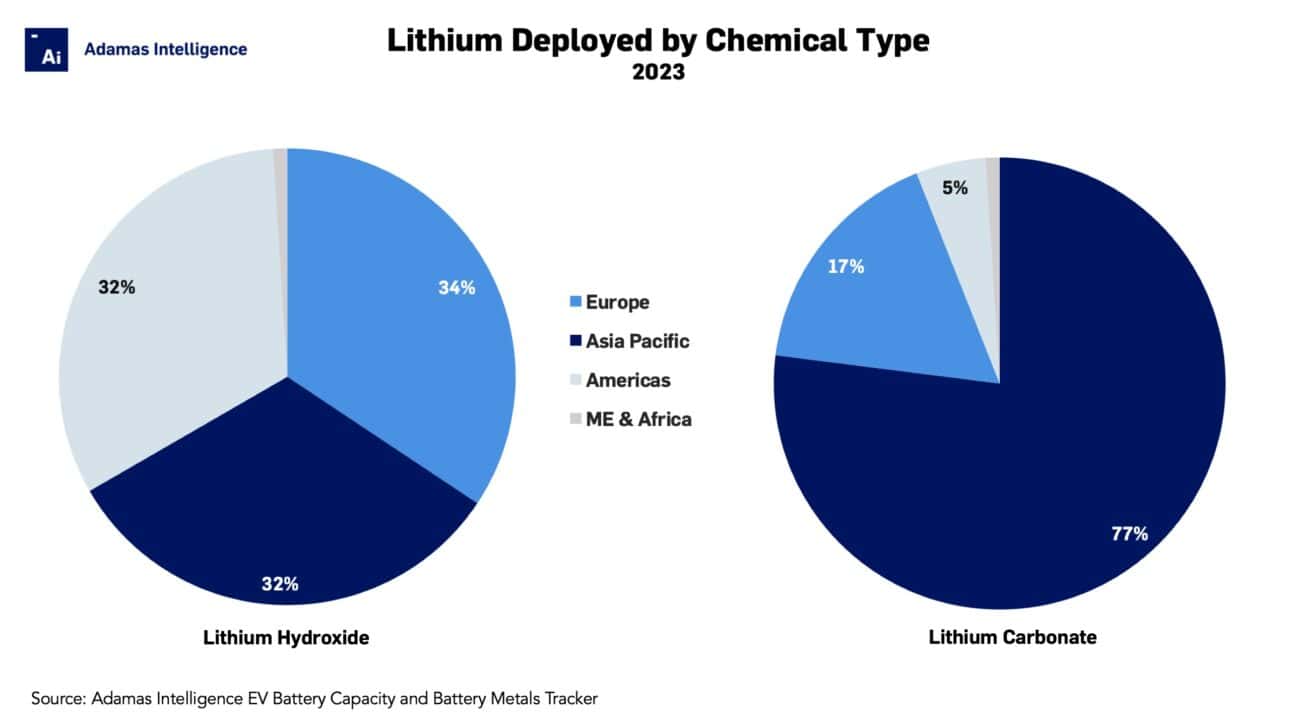

By lithium chemical, the Asia Pacific region drove 77% of global lithium carbonate consumption last year, a slight increase over the year before, and 32% of global lithium hydroxide consumption, down slightly year-over-year.

Moreover, Europe fueled 17% of global lithium carbonate consumption last year and 34% of global hydroxide consumption, both shares down from the year prior.

Lastly, the Americas powered just 5% of global lithium carbonate last year and 32% of global hydroxide use, both shares up versus 2022.

Adamas take:

The regional consumption patterns of lithium carbonate versus hydroxide correlate largely with the regional deployment patterns of cell chemistries by GWh.

In Asia Pacific, the world’s largest regional EV market by a longshot, LFP batteries made up 48% of the combined GWh deployed in newly sold EVs last year, hence the region’s dominance of global lithium carbonate use.

Conversely, in Europe and the Americas combined, LFP’s share was only 8% last year whereas high-nickel ternary batteries, which often use lithium hydroxide during CAM synthesis, dominated.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview