Stellantis, Leapmotor deal rolls on

No 3 and no 9

The proposed deal between Stellantis and Leapmotor has received a green light from China’s National Development and Reform Commission ahead of regulatory approval in other markets.

In October, Stellantis said it will invest $1.6 billion to acquire roughly 20% of the Chinese electric vehicle start-up, forming a joint venture to manufacture, export and sell the Chinese company’s EVs in Europe and elsewhere – as soon as 2025.

Amsterdam-headquartered Stellantis owns more than a dozen brands including European marques like Fiat, Alfa Romeo, Peugeot and Citroën, along with US stalwarts like Jeep, RAM trucks and Chrysler, and will have a controlling stake in the new joint venture.

Stellantis chief executive Carlos Tavares commented after the October announcement: “We don’t want to be the victims of the Chinese offensive on the world, we want to be leading the way and controlling it.”

The deal also aims to boost the Italian-American company’s struggling efforts in the world’s largest car market. In 2022, Stellantis dissolved a Chinese joint venture making Jeeps with Guangzhou Automobile Group (GAC). Stellantis sells Citroen EVs in the Asia Pacific region in an arrangement with manufacturer Dongfeng.

Hong Kong-listed Leapmotor, formed in 2015, has also found tough going in the highly competitive Chinese EV market. In terms of passenger BEV and PHEV sales last year, Leapmotor occupies the number 9 spot in China and the Hangzhou-HQ’ed company has underperformed overall EV market growth in its home base, which expanded by 32% in 2023.

Leapmotor’s market capitalization in Hong Kong has fallen more than 20% so far in 2024, meaning Stellantis is paying something of a premium for its stake. Stellantis is the world’s third most valuable car company with shares trading in Milan above the $100 billion mark after rising 17% year to date.

Euro-Sino entanglement

Last week, the UK was reported to have started an investigation into Chinese EV imports similar to a probe launched in October by the European Union, which accused Beijing of giving huge state subsidies to domestic carmakers to keep EV prices artificially low.

The bloc’s investigation could result in the imposition of trade sanctions or other punitive measures as soon as mid-year.

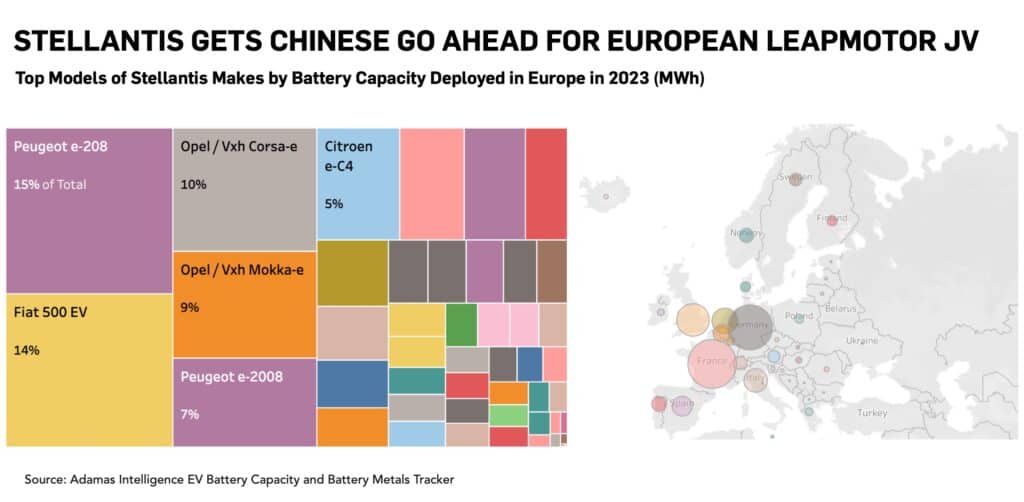

Adamas Intelligence data shows that in 2023, almost a fifth of all GWhs delivered to EV buyers in Europe, including Britain and non-EU states, were contained in China-made EVs and packs. The majority were non-Chinese brands including Dacia, BMW and Tesla.

How potential EU sanctions on Chinese EVs may affect automakers using Chinese cell suppliers remains unclear. Stellantis relied on the world’s number one battery manufacturer CATL for some three-quarters of the kWh powering its EVs sold in Europe last year.

Leapmotor’s main supplier is CALB, which has no presence in Europe, save for a limited number of Smart and Xpeng cars sold in the region equipped with its batteries.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview