US tariffs, EU probes: More roadblocks for BYD’s global expansion

It’s complicated

A week after BYD docked its first vehicle carrier in Europe and unleashed a price war at home, the world’s number one electric car manufacturer by volume stated publicly that it’s not out to conquer the US market.

Stella Li, executive vice president of BYD and CEO of BYD Americas, told Yahoo Finance the company is “not planning to come to the US” adding that “it’s an interesting market, but it is very complicated.”

Li also explained that BYD’s plans to set up a factory in Mexico are not aimed at backdoor entry into the US market and that the plant, for which a final investment decision is expected mid-year, will focus on the domestic market.

Li’s comments come as US lawmakers introduce legislation to hike already stiff import tariffs on vehicles imported from China taking the overall rate from 27.5% today to 125%. At the same time, a new 100% duty on cars assembled by Chinese automakers in Mexico would apply.

For good measure, the White House on the same day ordered an investigation into the national security risks posed by what was termed “Chinese smart cars” which could be used to gather sensitive data and spy on US citizens, or worse, be controlled by “somebody in Beijing”.

Also this week, the UK is reported to have started an investigation into Chinese EV imports similar to a probe launched in October by the European Union, which accused Beijing of giving huge state subsidies to domestic carmakers to keep EV prices artificially low.

The bloc’s investigation could result in the imposition of trade sanctions or other punitive measures as soon as mid-year.

Narrow tireprint

Faced with stiff competition and paper thin margins in its home market, where EV startup bankruptcies are also beginning to pile up, Shenzhen-based BYD is keen to roll into new markets.

To-date, BYD has made no inroads into the US and is largely absent from the Americas, except for Brazil where some 6,400 of its EVs found buyers last year.

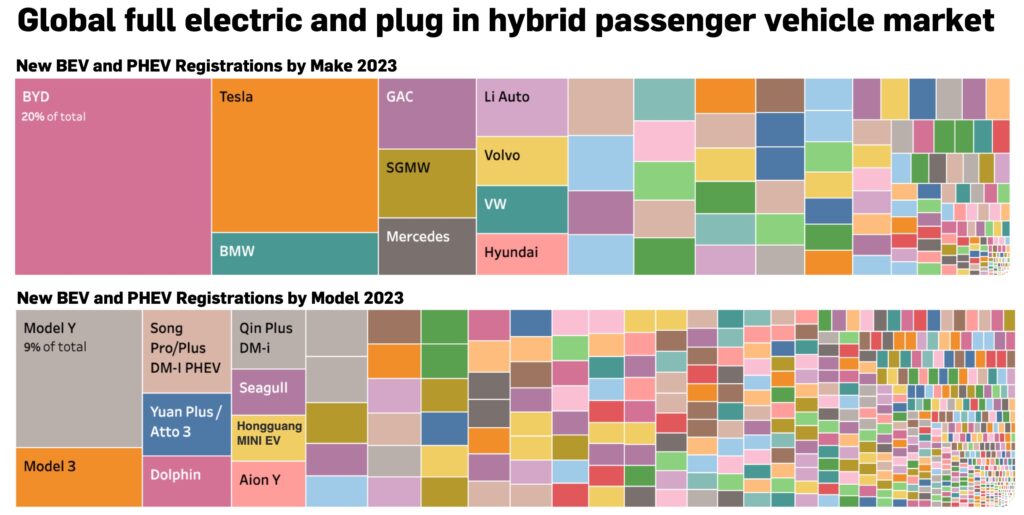

In China, BYD is streets ahead of the competition, capturing 29% of the Chinese market last year after selling 2.6 million EVs at the retail level.

By comparison, just over 610,000 Teslas were delivered to new buyers in China last year, placing the US-based company at number two in the world’s largest EV market by a country mile.

When it comes to market diversification, Tesla is in a much better position than BYD moving just shy of 700,000 units in the Americas, affording the Texas-based company a similar market share in the region to that enjoyed by BYD in China.

In Europe and the UK, Tesla’s customer count is just over half that in its home market. In contrast, BYD sold a mere 16,500 units on the continent (plus the UK) last year out of 3.2 million BEVs and PHEVs registered in the region.

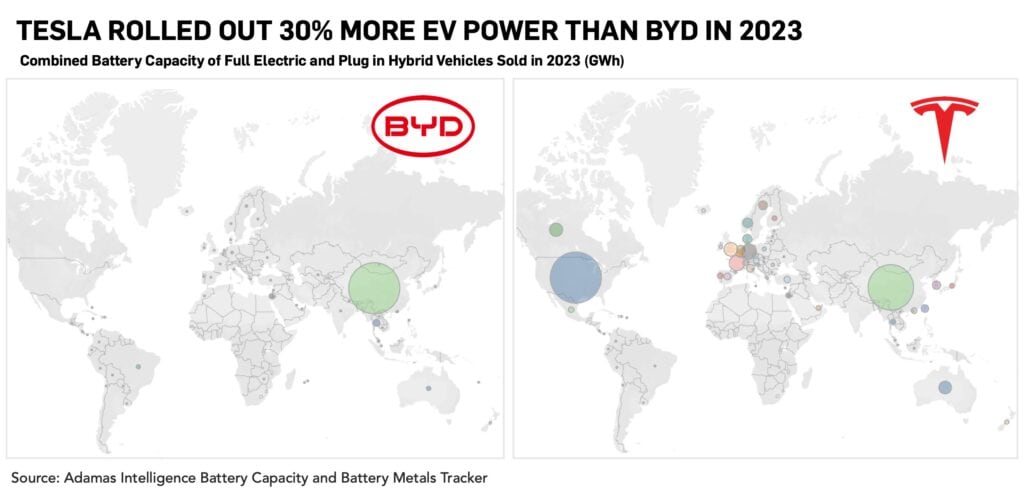

In terms of battery capacity rolled onto roads – which creates a fuller picture of the scale of global vehicle electrification than unit sales alone – Tesla remains way out front of BYD.

Tesla supplied 132.1 GWh of pack power to buyers of its S, 3, X, Y models in 2023, a 37% jump compared to 2022. And that’s before the Cybertruck, with its beefy 122 kWh cell pack (and optional 47 kWh range extender), goes full beastmode on the competition.

Over the same period, BYD upped its combined battery capacity deployment by 51% year-over-year to 101.6 GWh, with the gap to Tesla accounted for by the fact that around half of BYD’s sales last year were PHEVs, which have inherently smaller batteries than Tesla’s BEVs.

Hope springs electric

Last week BYD launched updated versions of its Qin Plus DM-I and Destroyer 05 plug-in hybrid sedans in China. At 79,800 yuan or just over $11,000, the updated models are priced 20% lower than previous versions of the popular cars.

In the US, the cheapest EV available has a sticker price almost three-times that of BYD’s budget cars with the full electric Nissan Leaf coming in at $29,280, followed by the Mini Cooper Classic at $31,895.

Similarly, the most inexpensive plug-in hybrid on sale in the US today is the Toyota Prius Prime, which has a purchase price of $34,070 according to TrueCar.

The same week that BYD threw down the gauntlet to its Chinese rivals, the first of the company’s new fleet of vehicle carriers docked at the Dutch port of Vlissingen. The BYD Explorer No. 1 is a roll-on roll-off vessel that can transport as many as 7,000 vehicles at a time.

Should BYD find customers for even just the first batch of Seals, Sea Lions, Seagulls and Dolphins washing up on European shores it would transform the brand’s fortunes in the region almost overnight.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview