BYD out to destroy competition in China (and Europe)

Melting ICE

BYD this week unleashed a price war in its home market with the launch of updated Qin Plus DM-I and Destroyer 05 plug-in hybrid sedans.

The new prices? At 79,800 yuan or just over $11,000, the updated models are priced 20% lower than previous versions of the popular cars and, according to BYD’s promotional material, 20% cheaper than a comparable gasoline-powered vehicle.

Volkswagen’s budget ICE model, introduced last year and assembled by state-owned automaker SAIC in China, the Lavida, goes for 94,000 yuan.

Last year, the Qin Plus DM-I was China’s fourth most popular EV (excluding conventional hybrids) with sales of over 300,000 units while the Destroyer found just under 90,000 new owners.

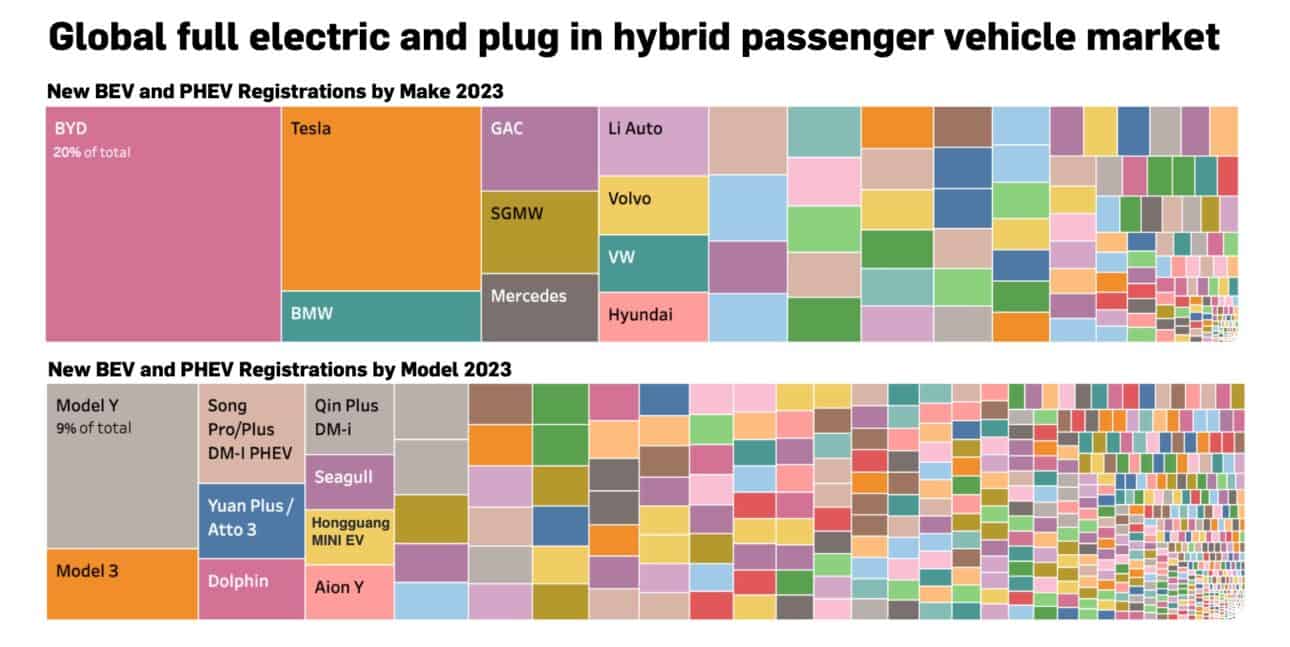

In its home market, Shenzhen-based BYD is streets ahead of the competition, capturing 29% of the Chinese market last year after selling a towering 2.6 million EVs at the retail level, around half of them PHEVs.

By comparison, just over 610,000 Teslas were delivered to new buyers in China last year, placing the US-based company ahead of GAC, which supplied 480,000 EVs to Chinese customers.

Harsh competition

BYD’s aggressive pricing strategy has forced competitors to respond. General Motors’ Chinese JV with SAIC and Wuling, as well as Changan and Hozon, lowered prices of their entry level models to below the “psychologically important” 100,000 yuan mark this week.

“It is a critical year for new-energy vehicle companies in 2024 because of harsh competition,” Cui Dongshu, general secretary of the China Passenger Car Association told the South China Morning Post:

“Most car assemblers are set to offer discounts and engage in price wars to retain market share.”

Competition is indeed harsh in the middle kingdom with no fewer than four Chinese EV startups declaring bankruptcy in the fourth quarter of 2023 alone.

Levdeo, Singulato and Enovate joined the vehicle unit of property giant Evergrande, itself now in administration after being buried in $300 billion in debt, at the wreck yard.

In China today, you can get behind the wheel of more than 300 different electrified models made by 110 assorted marques. With this level of fragmentation, a shakeout is inevitable despite the market growing at over 30% year-on-year.

Deals on Seals

The same week that BYD threw down the gauntlet to its Chinese rivals, the first of the company’s new fleet of vehicle carriers docked at the Dutch port of Vlissingen.

The BYD Explorer No. 1 is a roll-on roll-off vessel that can transport as many as 7,000 vehicles at a time.

Should BYD find customers for even just the first batch of Seals, Sea Lions, Seagulls and Dolphins washing up on European shores it would transform the brand’s fortunes in the region almost overnight.

In 2023, BYD sold a mere 16,500 units on the continent (plus the UK) out of nearly 3.2 million BEVs and PHEVs registered in the region.

But BYD’s shipments come at a difficult time for Chinese companies pursuing export opportunities in Europe.

In October, the European Commission formally launched an investigation into China-made EVs which the bloc says are flooding global markets at prices kept artificially low by huge state subsidies.

The investigation could result in the imposition of trade sanctions or other punitive measures as soon as mid-year.

Artificial or not, Chinese EV prices are bargain basement compared to those made elsewhere.

The cheapest BYD Seal went on sale in Europe in September last year for €45,990 in the Netherlands. That’s 360,000 yuan or just under $50,000.

The entry level Dolphin (in reality looks more like a monkfish) retails for €29,990, which is a long way away from even the 200,000 yuan psychological level but considering the Volkswagen ID.3 is at least €10,000 more, it’s a catch.

The cheapest passenger EV in Europe today is the Dacia Spring Electric 45, which can be had for just €22,550. It’s made in China.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report and data service for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

Back to overview