Lithium auction points to price upside potential

Price transparency

After a bounce from recent lows, Australian hard rock lithium producers, responsible for half the world’s output, can take heart from a successful auction by world no 1 producer Albemarle this week, which should further underpin prices.

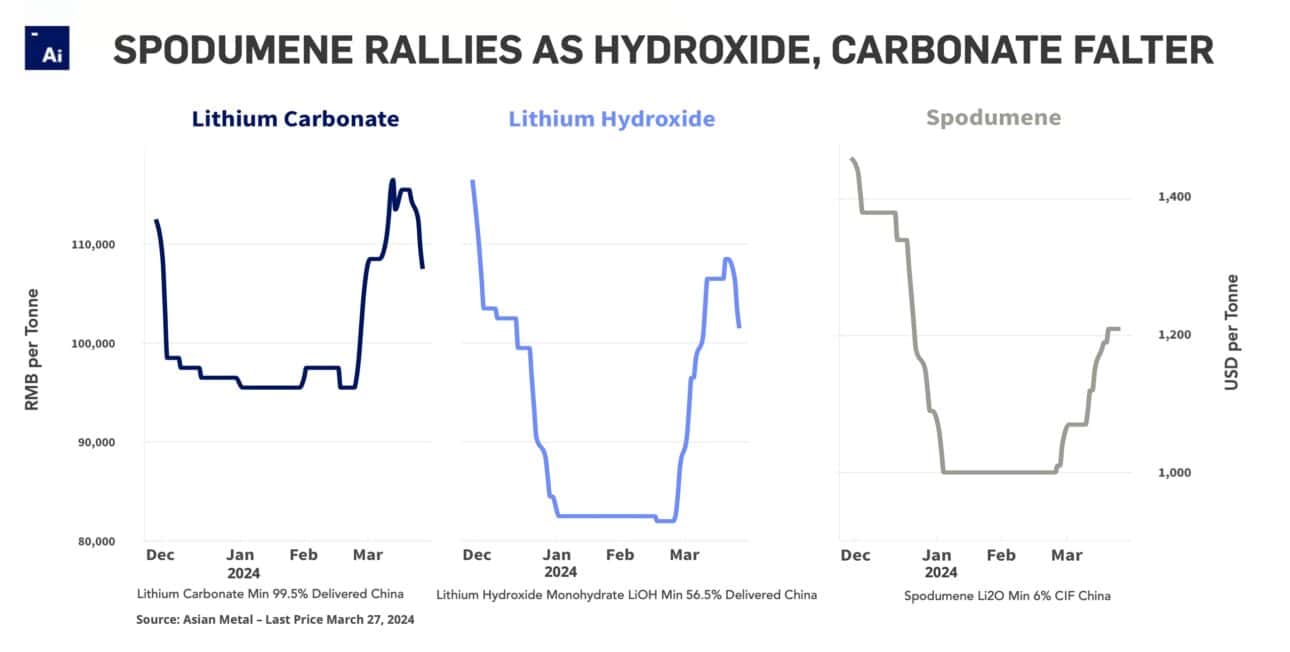

The West Australian reported Albemarle auctioned 10,000 tonnes of spodumene concentrate at $1,200 per tonne on Tuesday, in line with spot prices reported by Asian Metal (see graph) but well above levels pegged by other Chinese market data providers.

Charlotte, North Carolina-based Albemarle said the first of its kind auction, handled by LME partner Metalshub and priced in yuan, is an effort to improve price transparency in the market and an “approach to price discovery that can lead to fair product valuation.”

The transaction marks the first time the “chemical” company has ever sold spodumene concentrate, as historically its lithium is sold as a chemical, and mostly on fixed-term contracts.

Australian business paper the Financial Review also quoted Mineral Resources this week as saying the company recently sold 20,000 tonnes of spodumene at $1,300 per tonne from its Mt Marion mine, although that transaction was not part of an auction.

Still under pressure

After a brutal 2023 that saw prices collapse, China’s red hot EV market going into the lunar new year sparked a comeback of sorts for lithium.

In China, carbonate and hydroxide prices jumped to three-month highs at the outset of March only to turn back down as the end of Q1 approaches, with a depreciating renminbi adding to weaker dollar equivalent pricing.

Ex-works China, lithium carbonate is trading at a midpoint of RMB 107,500 ($14,870) per tonne this week while hydroxide is exchanging hands for RMB 101,500 ($14,040) per tonne.

As with lithium chemicals, prices for lithium iron phosphate (min 3.9% Li) in China are also coming off recent highs trading at RMB43,000 ($5,950) per tonne this week, according to Asian Metal.

Adamas take:

The “price discovery” rush by Albemarle, Mineral Resources and Pilbara Minerals appears circumstantial with available units in inventory and seemingly lackluster demand seen in early 2024. It has been successful thus far, however refiners had incentive given the disconnect between spodumene and chemical prices.

Inferring from the China spot lithium carbonate price, inclusive of a 10% operating margin to converters, the implied SC6 price CIF China is ~$1,350 per tonne. Toll refiners, perhaps of the opinion lithium carbonate prices have bottomed out, are therefore motivated to lock in their margin using sub-$1,350 per tonne SC6 units, which helps explain the upward move we’ve seen in spodumene prices.

With the gap closing, further upside in spodumene prices may be constrained until their chemical counterpart moves higher.

With the low hanging fruit being plucked, it remains to be seen whether continued success of this marketing tactic becomes a mainstay feature for the rest of 2024, much like it did with Pilbara Minerals BMX auctions in the 2021 price rally.

Chris Williams, Analyst at Adamas Intelligence

Chris is an Analyst at Adamas Intelligence focused on the global lithium industry. He researches and analyzes the lithium value chain to uncover actionable opportunities for clients.

Chris has 11-years experience in mining and oil & gas operations optimization, delivering value from data intensive insight generation. He completed his Bachelor and Masters of Engineering at the University of Queensland, majoring in Mechanical Engineering, and is currently completing a Masters of Business Administration at the University of British Columbia.

EV, Battery and Battery Materials Market Intelligence:

EV Battery Lithium Monthly

The ‘EV Battery Lithium Monthly’ is a subscription-based report and data service for tracking end-to-end, market-moving developments across the global EV, battery and lithium supply chain.

EV Battery Capacity and Battery Metals Tracker

Building on ongoing EV registrations in over 110 countries, our web-based platform helps users track monthly deployment of battery metals and materials, battery capacity, and the ever-evolving competitive landscapes of battery chemistries and cell suppliers.

EV Battery Capacity Monthly

The ‘EV Battery Capacity Monthly’ is a subscription-based report for tracking monthly deployment of passenger EV battery capacity by EV type, region, country, make, model, cell supplier and cell chemistry on an ongoing basis.

Back to overview